XRP Surge Decoded: Long-Term Holders Hang On, Attention Focused on Crucial Price Point!

Ripple's XRP is making some noise, and it's no ordinary chatter. Long-term investors are keeping their coins close, and that's a good sign.

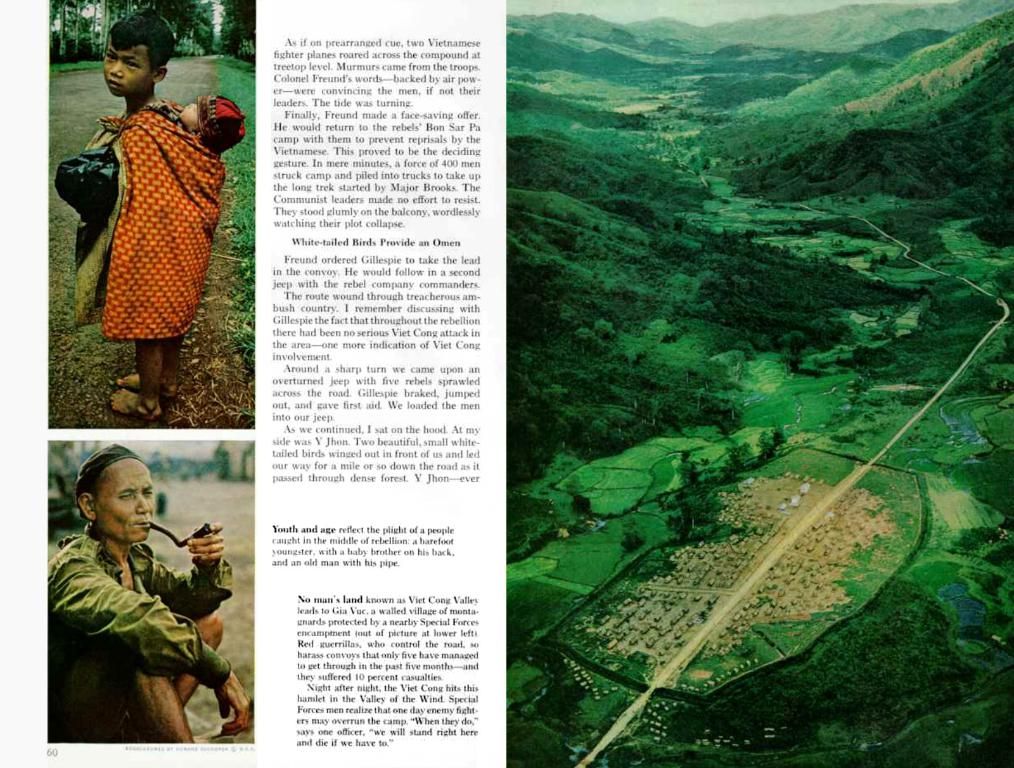

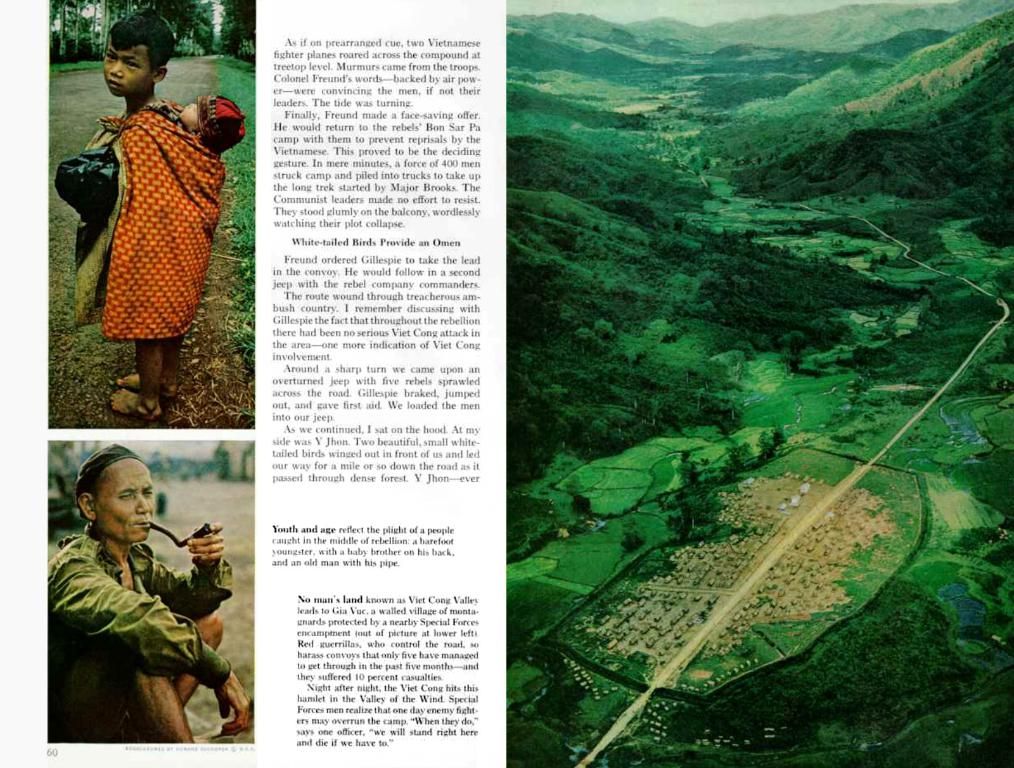

The not-so-subtle shift among XRP's long-term holders (LTHs) is evident in the token's "liveliness" - a metric that monitors the activity of inactive coins. According to Glassnode, it has dipped by 1% since June 5, now resting at 0.809 by June 8.

What does this mean? It suggests LTHs aren't selling or moving their coins. Instead, they're either holding onto them or transferring them off exchanges, a telltale sign of bullish accumulation.

The XRP party doesn't stop in the spot market. It carries over to the derivatives scene, too. Since June 6, XRP has enjoyed consistently positive Open Interest-Weighted Funding Rates, around 0.0099% at press time.

Here's the thing: When the Funding Rate is positive, it usually means traders are going long, while the short sellers pay to keep their bearish bets open. This is evidence of a confident market and supports the notion of growing interest in XRP's short-term price movement.

It's all going up for XRP, right? Not so fast. Although it's been gaining ground, the token could be approaching a significant technical hurdle.

At press time, the Relative Strength Index (RSI) was at 54.81, a neutral zone but bordering on overbought. It's telling us that buyers have room to push, but cautiously so. Meanwhile, the MACD histogram turned green, and the signal line crossover hints at a potential continuation of the bullish trend.

But, there's a catch. Today's red candle and intraday rejection near $2.32 exposed short-term resistance. If bulls fail to reclaim this level, XRP might find itself in a consolidation phase. Despite this, the momentum remains in the bulls' favor... for now.

Ready for more crypto insights? Check out our must-read daily newsletter!

Sui soars 6% after key breakout - $4 nears | Solana rallies 8.5% after $143 retest - Time for a major recovery?

Cryptocurrencies continue to make waves, with XRP's performance being a topic of interest. Long-term holders (LTHs) are showing signs of bullish accumulation, as indicated by a dip in the 'liveliness' metric and consistent positive Open Interest-Weighted Funding Rates. However, XRP might be approaching a significant technical hurdle, as its Relative Strength Index (RSI) is nearing the overbought zone and a short-term resistance has been exposed near $2.32. Despite this potential consolidation, the momentum remains in the bulls' favor. Meanwhile, Solana is also gaining ground, recording an 8.5% rally after a $143 retest, suggesting a possible major recovery.