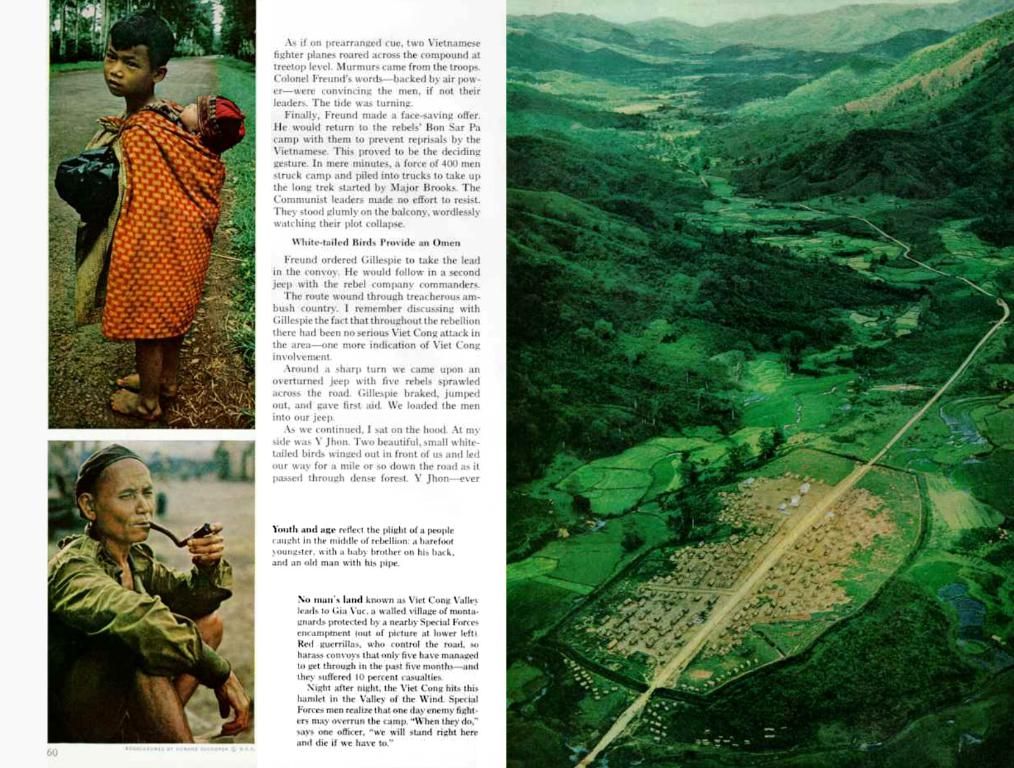

Unlocking of $40B in Altcoins Results in Potential 50% Losses for Locked Token Holders: STIX Paraphrased

Unveiling the Painful Truth: Locked Tokens and the Crypto Bloodbath

It's a chilling tale of woe for investors holding onto locked tokens—they've taken a crippling blow over the past year, outpacing even the most dismal market declines. Data from industry insider Taran Sabharwal paints a grim picture.

Between May 2024 and April 2025, the average slip from over-the-counter (OTC) valuations to current market prices clocked in at a staggering 50%. But it's not just the numbers; the analysis reveals that numerous investors missed a golden opportunity to offload their tokens at twice their current value in 2024.

A Nightmare Scenario for Token Hodlers

The drop in value is a double-edged sword for these early-stage token investors, who committed to locked positions. Market conditions and project-specific issues have brought havoc, with nearly every tracked project registering substantial losses. Scroll (SCR) and Blast (BLAST) bore the brunt, plummeting by 85% and 88%, respectively. Eigenlayer (EIGEN) followed suit with a devastating 75% dive. Others, like ZKsync (ZK) at -64%, Wormhole (W) at -50%, and io.net (IO) at -48%, also tumbled precipitously. The only project showing any resilience was Jito, which surged 75% over the same period.

The overall picture highlights a disheartening reality: locked token investors have faced greater losses than the broader crypto market. Data from Artemis confirms this, revealing an average decline of 40.7% for the market, about 20% less severe than the average loss for locked tokens.

Adding Insult to Injury

Investors are also grappling with an additional 31% in opportunity cost compared to Bitcoin (BTC), which rallied 45% during the same period. To make matters worse, an estimated $40 billion in locked altcoins is set to hit the markets soon, selling at a 50% discount through OTC markets.

Crunching the numbers, $1 invested a year ago would now send your BTC soaring to $1.45. But the same dollar locked in an unreleased token is now slumping at $0.50, and with the OTC discount, it would fetch a paltry $0.25. This translates to an alarming total value loss of approximately 82.8% compared to BTC and 75% compared to the USD.

Further, as most cryptocurrencies approach the end of their lock-up periods in 2025, discounts have eased slightly due to shorter vesting durations. But the sting of such devastating losses will linger.

The Ghosts in the Machine

Locked tokens come wraped in restrictions and vesting schedules that prevent instant liquidation during the lock-up period. This leaves holders at the mercy of price fluctuations, unable to bail out during market downturns.

Three Key Factors Unraveled

- Concentrated Power Plays: Disproportionate control of locked tokens by project creators fuels coordinated sell-offs, such as the $HAWK and Trump Coin debacles.

- Imposed Illiquidity: Locked tokens trap investors during volatility, forcing them to absorb losses while developers retain profits.

- Lax Regulations: Lacking vesting schedules, centralized revenue models, and legal clarity make locked tokens prime candidates for market chaos, as exemplified by the SEC's scrutiny of $HAWK and lawsuits against other projects.

So, as you button your crypto wallet amidst the current market carnage, remember to heed this cautionary tale. Locked tokens may look tempting, but they come with a heavy price tag.

Binance Free $600 (our website Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binancefull detailsLIMITED OFFER for our website readers at Bybit: Use this link to register and open a $500 FREE position on any coin!Crypto Investments Facebook Twitter LinkedIn Telegram

- Despite the cryptocurrency market's declines, investors holding onto locked tokens have experienced even sharper losses, with an average drop of 40.7% compared to a 20% less severe market average.

- In the upcoming year (2025), an estimated $40 billion in locked altcoins is expected to enter the markets, selling at a 50% discount through OTC markets, further exacerbating investors' losses.

- Three key factors have contributed to the difficulties faced by locked token investors, including concentrated power plays, imposed illiquidity, and lax regulations.

- Between 2024 and 2025, numerous projects tracked saw substantial losses, with Scroll (SCR) and Blast (BLAST) plummeting by 85% and 88%, respectively, while Eigenlayer (EIGEN) dived 75%.

- The overall market situation points to a painful reality for investors holding onto locked tokens, as these assets have shown greater losses than both the broader crypto market and Bitcoin (BTC).

![Shocking Allegations Against [Name]: Potential Financial Misconduct Uncovered in Substantial Investigation Investors in locked tokens suffered an average loss of 50%, with some altcoins plummeting as much as 88% from their over-the-counter (OTC) valuations.](https://financialdigest.top/en/img/2025/04/27/1195448/jpeg/4-3/1200/75/image-description.webp)