Struggling to Match Earnings with Rising Prices: Financial Advisor's Strategies to Close the Inflation Gap

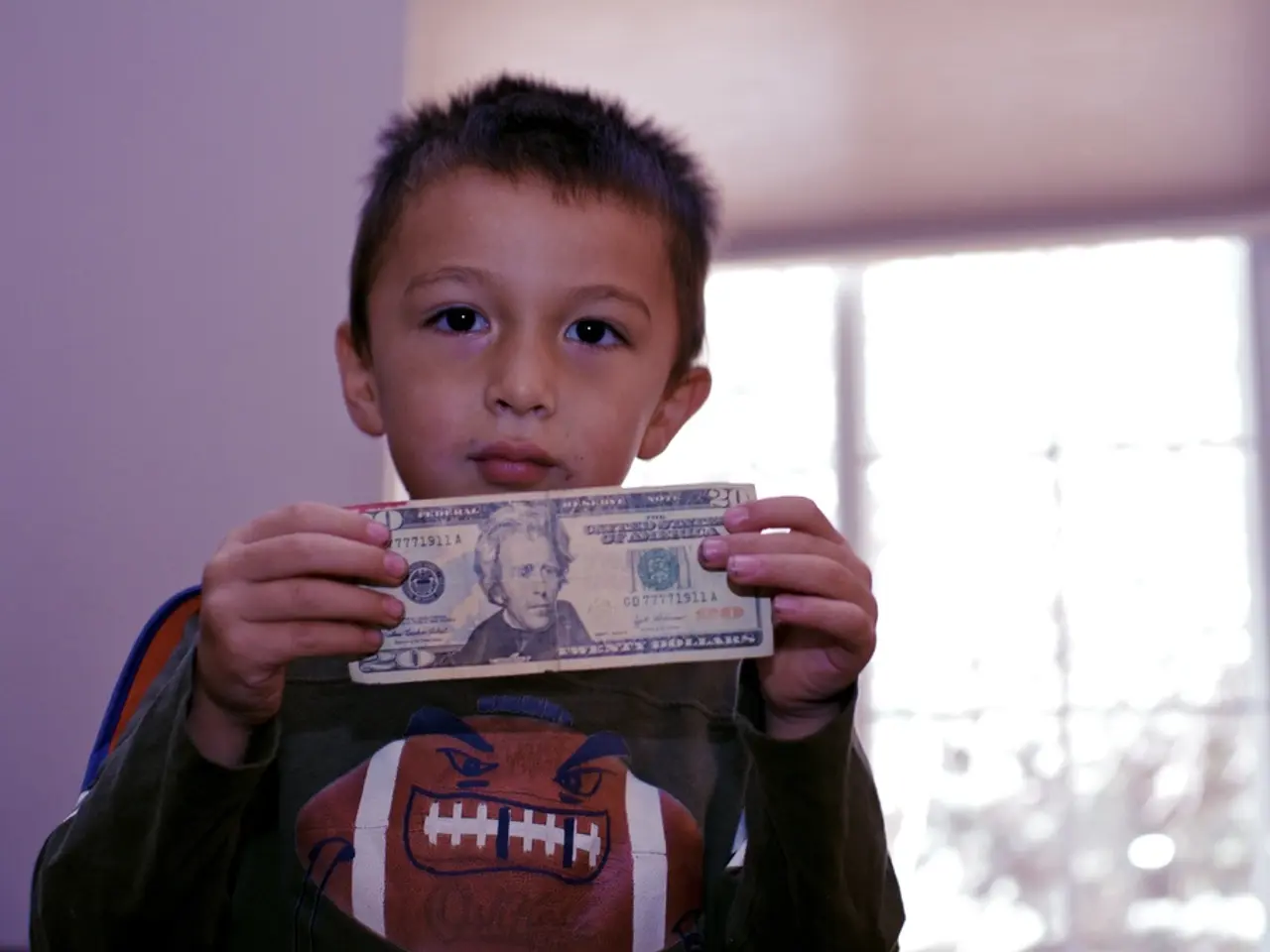

Inflation has been on the rise, with the Bureau of Labor Statistics reporting a nearly 23% increase since January 2021. This surge has left many households feeling the pinch, leading to a decrease in consumer confidence. The University of Michigan's Consumer Sentiment Survey showed year-ahead inflation expectations among Americans grew to 4.8% in August, reflecting this dwindling confidence.

One way to combat these financial pressures is by being proactive with your expenses. Calling providers for discounts on recurring bills like internet, insurance premiums, phone service, or utilities can help reduce expenses during periods of inflation. Additionally, having a budget is crucial to determine the best use for each dollar, including essential expenses, trimming unnecessary spending, achieving savings goals, and debt repayment.

Building an emergency fund can provide a cushion for unexpected costs and prevent charging up credit cards. This can be achieved by batch cooking, swapping name brands for generics, or growing some of your own produce to cut costs on grocery expenses. Furthermore, putting some savings into a high-yield savings account or investing it can help maximize those dollars.

Maximizing your current employer's benefits can also contribute to financial stability. Employers may offer benefits such as commuter stipends, wellness reimbursements, or education credits, which can help reduce out-of-pocket costs. Participating in the gig economy by providing services like Uber, DoorDash, or Instacart can provide flexible opportunities to earn additional income.

Another important strategy is to utilise the avalanche or snowball methods to pay off debt more efficiently. Sticking to a household budget can help implement these strategies effectively.

In the face of rising prices, it's crucial to have a plan in place to help bridge the gap and build long-term financial stability. This may involve asking for a raise from your employer or exploring advisory expertise on wealth building and preservation, such as the network called Adviser Intel.

Lastly, wages have risen by 21.5%, but they have not quite kept up with inflation. As such, it's essential to approach financial management with a proactive and strategic mindset to weather these economic challenges.

Read also:

- Federal petition from CEI seeking federal intervention against state climate disclosure laws, alleging these laws negatively impact interstate commerce and surpass constitutional boundaries.

- Duty on cotton imported into India remains unchanged, as U.S. tariffs escalate to their most severe levels yet

- Steak 'n Shake CEO's supposed poor leadership criticism sparks retaliation from Cracker Barrel, accusing him of self-interest

- President von der Leyen's address at the Fourth Renewable Hydrogen Summit, delivered remotely