Strategies for Commencing Frugal Hoarding (Even With No Previous Experiences)

Saving money doesn't have to be a chore. With persistence and creativity, you can transform it into a rewarding habit that pays off for years to come. Starting can feel daunting, but the most important thing is to just start—no amount is too small, and no goal is too insignificant.

To effectively build and manage a savings plan, follow these strategies:

- Set Clear Financial Goals and Separate Accounts Identify your savings objectives (emergency fund, retirement, down payment, vacation, etc.) and open separate savings accounts dedicated to each purpose. This "out of sight, out of mind" approach reduces the temptation to spend and improves motivation by tracking progress toward distinct goals.

- Automate Savings Implement the “pay yourself first” principle by setting automatic transfers from your checking to your savings accounts on payday. Automatic deposits, including employer direct deposit splits, help make saving consistent and effortless.

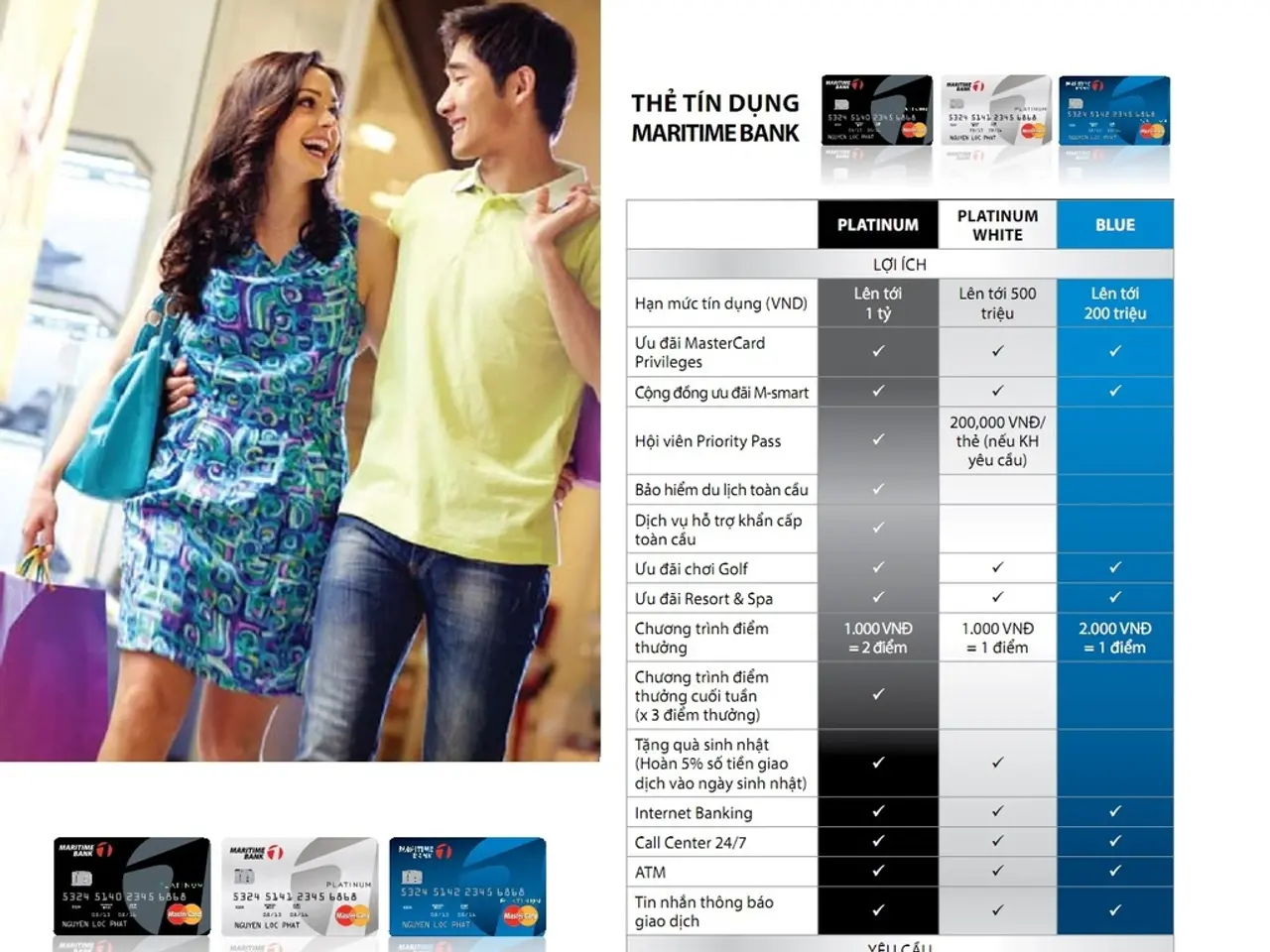

- Prioritize High-Interest Debt Repayment Paying off high-interest debts like credit cards should be a top priority, as their interest can erode any gains from saving. Use strategies like the debt snowball (smallest debts first) or avalanche method (highest-interest debts first) to free up future funds for savings.

- Track Spending and Budgeting Use budgeting tools or apps to track income and expenses, making you aware of discretionary spending you can cut back on. Allocating the saved money directly into savings accelerates your plan.

- Use High-Yield Savings Accounts Place your savings in high-yield savings accounts or similar vehicles to benefit from higher interest rates, helping your funds grow faster than in standard accounts.

- Invest for Long-Term Growth and Retirement For longer-term goals like retirement, diversify investments across stocks, bonds, and real estate to reduce risk. Use tax-advantaged retirement accounts (e.g., IRAs, 401(k)s) to maximize growth potential and tax benefits. Consider investing in low-cost index funds for broad market exposure and compounding growth.

- Use Tools and Technology Leverage mobile banking apps, membership discounts, and budgeting tools to make saving easier and track progress.

Combining these strategies creates a robust and flexible savings plan, integrating savings automation, disciplined spending, debt management, protected and goal-specific funds, and growth through investment. Each element supports different aspects of financial security and growth.

Remember, tailor the plan to your income, expenses, risk tolerance, and timeline. Consistency and regular review of goals and progress are key to adapting the plan as circumstances change.

Embrace new strategies and tools until you find the ones that work best for your unique situation and personality. Some options include:

- Using round-up programs that automatically round your debit card purchases to the nearest dollar and transfer the spare change to your savings.

- Automating your savings by setting up recurring transfers from your checking account to your savings account each payday.

- Utilizing money-saving apps like Digit or Qapital to analyze your spending habits and automatically move small amounts of money into your savings when you can afford it.

- Finding extra cash streams to boost your savings, like a side hustle, selling unused items, or depositing gift money directly into your savings account.

- Temptation bundling—pairing a task you don't enjoy with a reward you do enjoy, like only listening to your favorite podcast while reviewing your budget and canceling unused subscriptions.

- Separating your checking and savings accounts at different banks to create a psychological barrier between your spending money and your savings.

- Looking for areas to cut back on spending, such as subscriptions you don't use or impulse purchases you later regret.

With dedication and the right strategies, you can turn saving into a rewarding habit that sets you up for a secure financial future.

To achieve a secure financial future, consider using a combination of strategies such as separate savings accounts for distinct goals, automatic transfer of funds to savings, investment in high-yield savings accounts, and tracking spending through budgeting tools. Additionally, prioritize paying off high-interest debt and explore tactics like round-up programs, automating transfers, or using apps to analyze spending and save money.