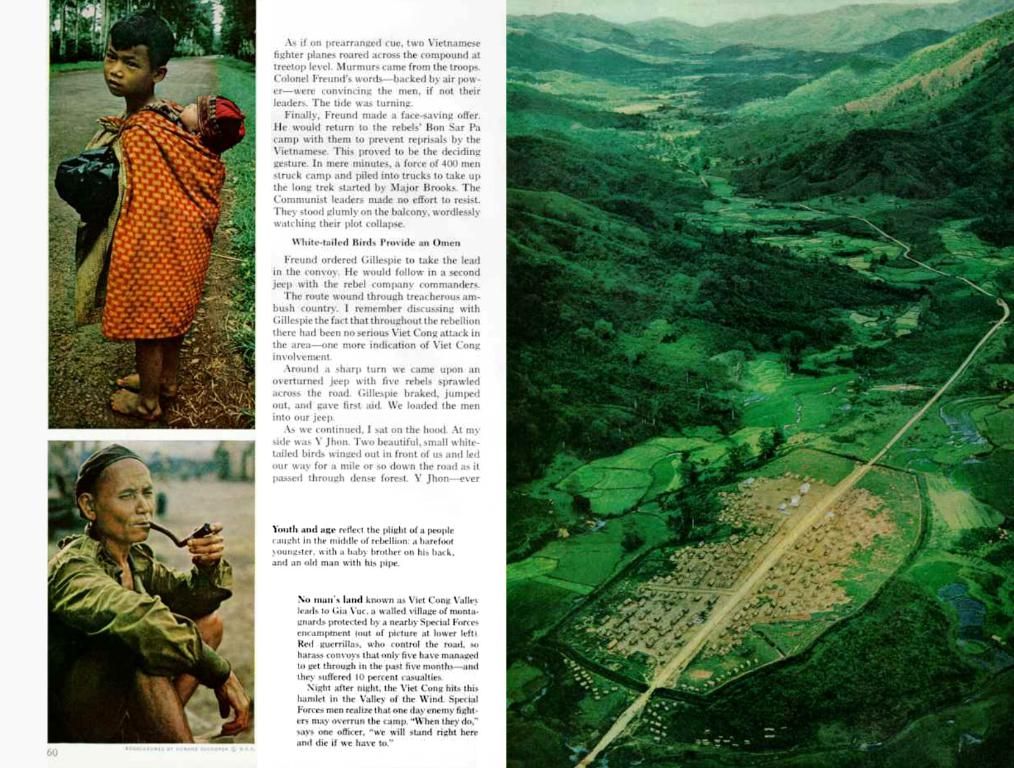

Stock markets across Europe commence with optimistic gains, mirroring the upward trend observed on Wall Street.

At 9:00 AM in Lisbon, the EuroStoxx 600 was climbing 0.50%, standing tall at 519.11 points.

London, Paris, Frankfurt, and Madrid took a small yet positive stride, with gains of 0.06%, 0.62%, and 0.21% respectively, while Milan and Madrid stormed ahead with increases of 0.81% and 0.59%. The Lisbon stock exchange mirrored this upward trend, with the main index, the PSI, surging 0.56% to 6,917.01 points.

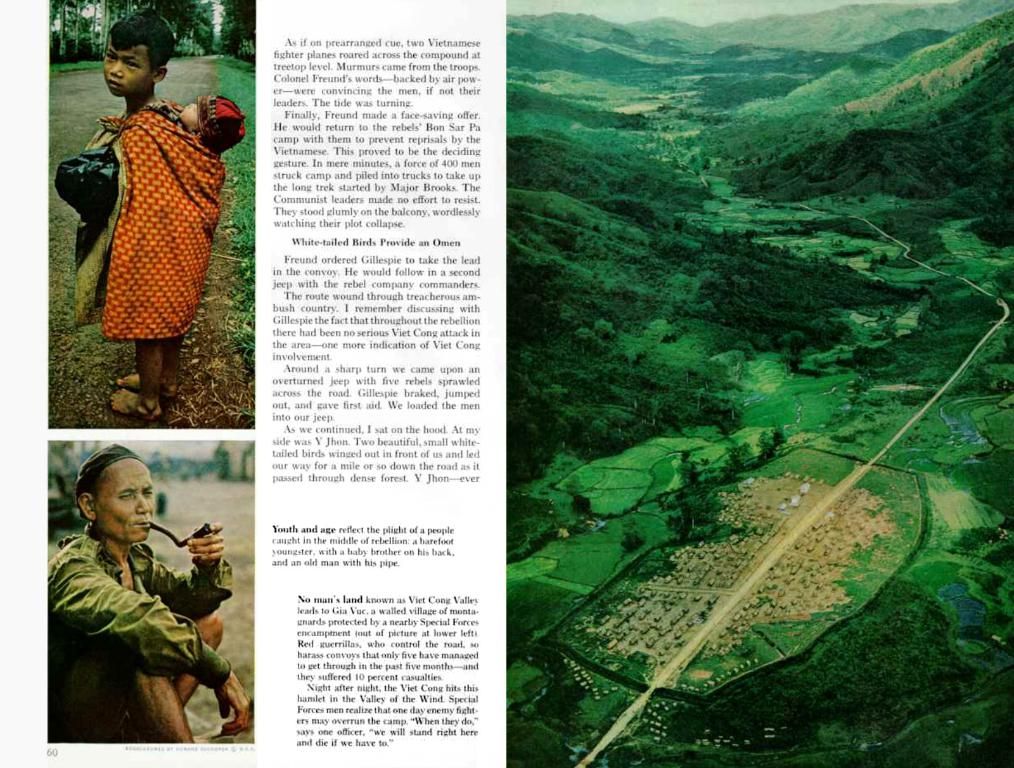

In Asia, the Tokyo Stock Exchange's main index, the Nikkei, ended the day adding around 2%, while the Hang Seng, just before closing, was up 0.67%. The Chinese Communist Party (CCP) advanced its strategies to bolster and stimulate the economy, attempting to lessen the impact of the trade war with the United States.

Meanwhile, India's BSE Sensex and Nifty 50 indices suffered significant losses in today's trading, amidst escalating diplomatic tensions with Pakistan following terrorist attacks in Kashmir.

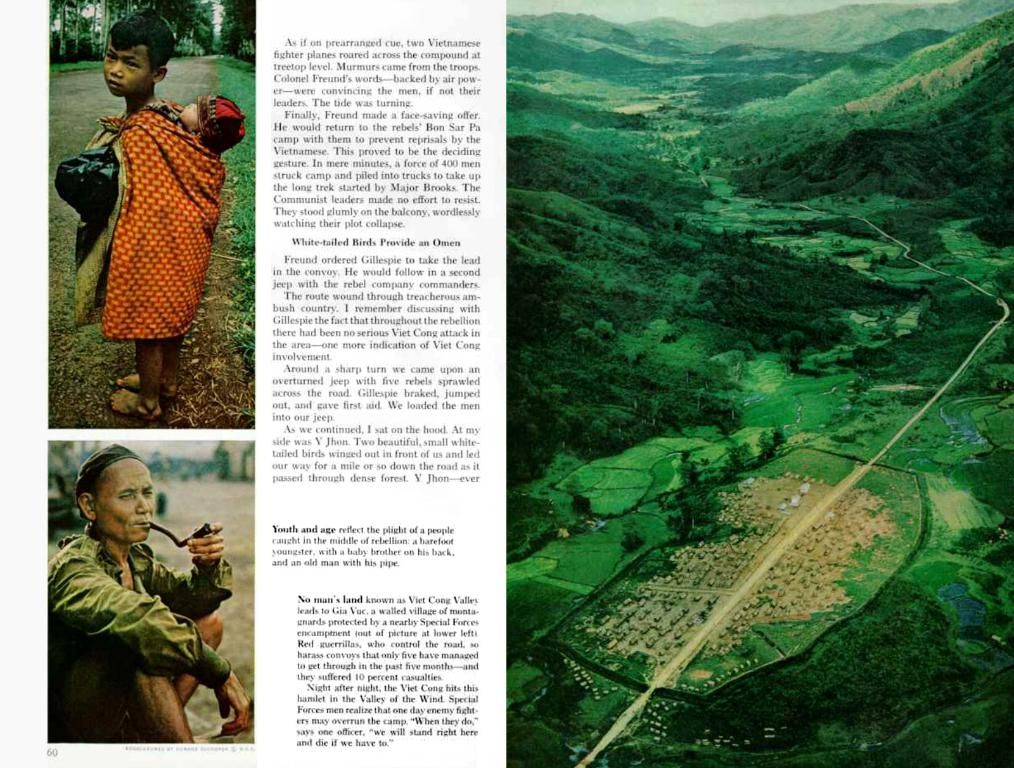

US stock markets thrived on Thursday, with the Dow Jones, S&P 500, and Nasdaq all ending the day in the green. Alphabet, Google's parent company, reported a staggering $34.54 billion (€30.322 billion) in Q1 earnings, a nearly 50% increase year-on-year.

Spanish insurance giant Mapfre announced a net result of €275.9 million in Q1, a 27.6% surge compared to the same period in 2024, despite a €85 million hit from California wildfires.

Germany's and Spain's 10-year bond yields rose to 2.469% and 3.103% respectively, while the price of gold dropped 1.37% to $3,303. Oil prices rose, with Brent gaining 0.63% at $66.97 and the North American WTI up 0.70% at $63.23 before market opening.

With the euro depreciating 0.34% and trading at $1.134, bitcoin tacked on 0.13%, reaching $93,571.

On March 25, 2025, at 9:00 AM, the EuroStoxx 600 may have been experiencing volatility, reflecting the broader market's economic uncertainties and trade concerns. However, the index performed well overall in Q1, outperforming major US indices like the S&P 500, indicating a resilient market. Accessing financial databases or real-time market data feeds would provide precise intraday data for this specific date.

- The EuroStoxx 600, standing tall at Milan's stock exchange, may have been experiencing volatility at 9:00 AM on March 25, 2025.

- In the bustling world of business and finance, the Seng 600 index, a reflection of Milan's stock market, performs alongside other major trading hubs like London, Paris, Frankfurt, and Madrid.

- Averaging 571 points, the Seng 600, incorporating the Finance industry and several key stocks, mirrors the ups and downs of the broader market, including Technology and other sectors.

- Investors looking to diversify their portfolios might find Italian stocks, represented by the Seng 600, an intriguing addition, as they navigate the complex landscape of global markets.

- Amidst the intertwined realms of industry, technology, and trade, the Seng 600, Milan's primary stock index, offers a glimpse into the economic pulse of Europe, providing insights for those engaged in the intricate game of investing.