SEC Commissioner Criticizes Ripple Settlement Decision

Check Out Ripple's Bust-Up with the SEC on Google News

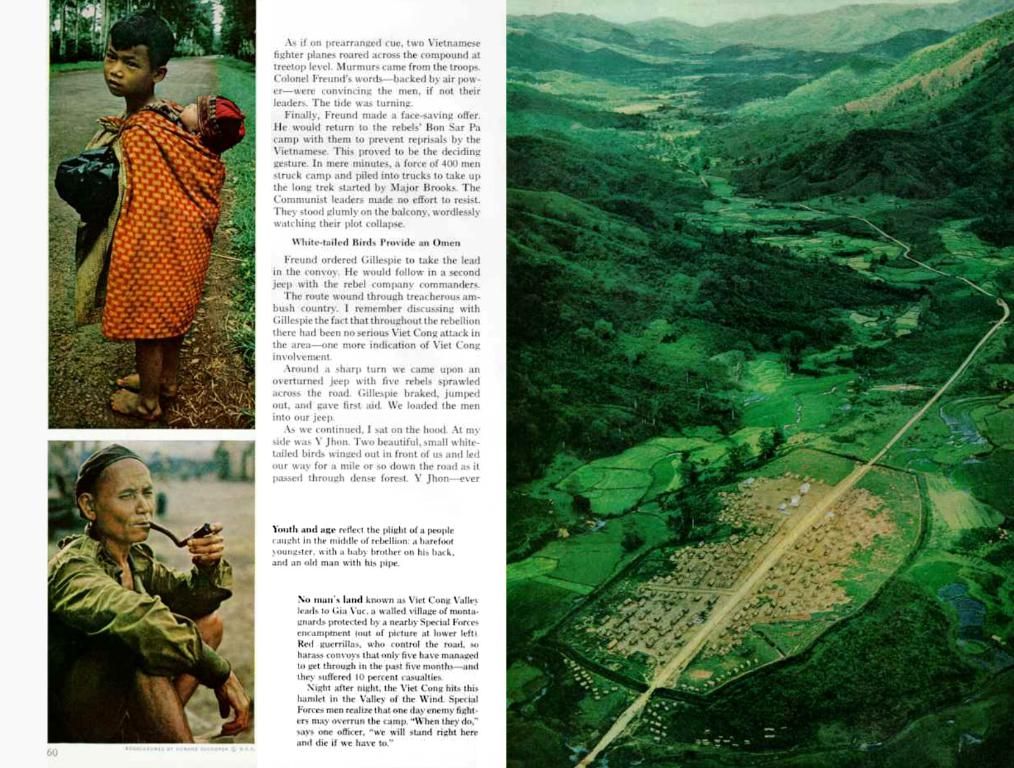

Caroline Crenshaw, the solitary Democratic SEC commissioner, has unleashed a fierce critique of the agency's settlement agreement with Ripple Labs in a fiery dissenting statement.

Crenshaw, known for her skepticism towards crypto, declares that the settlement "deals a massive blow to the investment public."

The commissioner accuses the agency of undermining the court's order and its enforcement efforts with this settlement.

SEC Slaps Down Ripple - Grim Remarks by Crenshaw Revealed

Piling on the criticism, she alleges that the agreement is a "smokescreen" for investor protection and weakens enforcement efforts in the crypto sector.

Intriguingly, she suspects that the new SEC administration is scared of winning the appeal since it could undermine the dismantling of cryptocurrency enforcement.

"Our agency is afraid of a solid ruling," she stated.

As reported by U.Today, the SEC recently requested an indicative ruling from a New York district court.

Under the settlement terms, Ripple's initial fine of $125 million, which was imposed by Judge Analisa Torres last year, has been slashed to $50 million. Additionally, the injunction previously imposed on Ripple has been lifted as part of the agreement.

For now, the case resides in the Second Circuit Court of Appeals, and it needs to be sent back to Judge Torres for the appeal to be finalized. Once both parties drop their appeals, the case will be officially over.

Notably, the summary judgment ruling stands under the agreement. However, Crenshaw insists that the SEC will fail to act if Ripple decides to sell unregistered XRP tokens to institutions again.

#Ripple News

interestingly, she believes the settlement may signal a retreat from robust enforcement in the crypto sector, potentially leaving investors less protected from future misconduct. Moreover, she warns that this settlement is part of a broader pattern of enforcement retreats that erode the SEC's credibility and its lawyers' ability to argue for strong regulatory positions in court.

In essence, Crenshaw's criticism revolves around concerns regarding weakened oversight, reduced investor protection, and the potential stifling of future SEC enforcement actions in the crypto industry. Her dissent underscores the ongoing internal debates within the agency over crypto regulation.

Sources:[1] "ACCOUNTING TODAY"[2] "LEGAL BUSINESS WIRE"[3] "BLOOMBERG LAW"[4] "COINTEKST"[5] "SEC RESEARCH"

- The SEC's settlement with Ripple, criticized by Commissioner Caroline Crenshaw, might be a retreat from robust enforcement in the crypto sector, she suggests, potentially leaving investors less protected from future misconduct.

- Crenshaw, known for her skepticism towards crypto, accuses the SEC of weakening enforcement efforts in the crypto sector and deals a massive blow to investor protection with the Ripple settlement.

- The SEC's settlement with Ripple, according to Crenshaw, is a "smokescreen" for investor protection and undermines the court's order and its enforcement efforts.

- The new SEC administration, Crenshaw implies, may be scared of winning the appeal against Ripple, fearing it would undermine the dismantling of cryptocurrency enforcement.

- Interestingly, Crenshaw warns that this settlement is part of a broader pattern of enforcement retreats that erode the SEC's credibility and its lawyers' ability to argue for strong regulatory positions in court.

- The settlement between the SEC and Ripple, as declared by Crenshaw, may signal a potentially stifling of future SEC enforcement actions in the crypto industry due to weakened oversight.

- Crenshaw believes that the SEC will fail to act if Ripple decides to sell unregistered XRP tokens to institutions again, further suggesting concerns over reduced investor protection and weakened enforcement efforts.