Ruble Remains Resilient amid Market Volatility

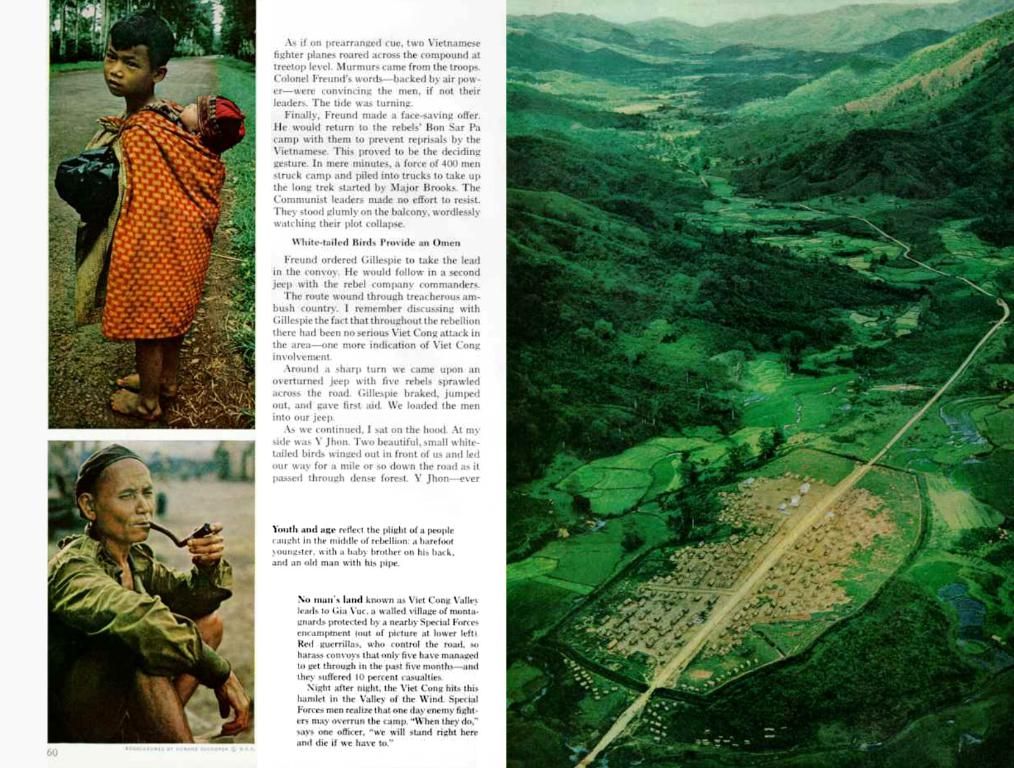

Ruble strengthening through dividend payments

In the heart of 2025, the Russian ruble maintains its robust stance, defying the stormy global markets. Exporters dumped $7.3 billion worth of foreign currency earnings in May, marking a 27% decrease from April, primarily due to plummeting oil prices and fewer workdays. Yet, the net sales volume sank to levels last seen in the summer of '23, under the watchful gaze of the Central Bank (CB).

Surprisingly, demand for foreign currency hit rock-bottom in the sunny days of May '25, reaching a June '24 low of 1.6 trillion rubles – a 12% decrease from April and a staggering 35% drop from Q1 '25's average. The CB credits the falling interest in greenbacks and yuan to a tight monetary policy, making ruble assets more alluring.

Despite the Bank of Russia reducing its key rate by 1 percentage point to 20% per annum on June 6, the lure of ruble investments remains undeterred. Analysts like Natalia Milchakova from Freedom Finance Global predict deposit interest rates will slide to 17-18% per annum by autumn, making foreign currency deposits a dull choice.

The banking world agrees. Alexander Potavin, analyst at FG 'Finam,' echoes Milchakova's sentiments, emphasizing low foreign currency deposit rates and restrictions on withdrawing foreign currency from accounts keep people from foreign currency deposits.

The Central Bank's latest hair-raising revelation? The ratio of net foreign currency sales to export earnings by major exporters hit 97% in March 2025, a 2 percentage point decrease from February 2025. Back in June '24, this ratio peaked at 115%, mainly due to exporters offloading foreign currency reserves to pay dividends. The ruble thrived against the dollar by an impressive 5.1% in June '24. Analysts bet the dividend season will strengthen the ruble again in '25.

Natalia Milchakova explains that a mere 43% of issuers will shun dividends in '25, with the ratio of issuers paying and not paying dividends remaining unchanged since '24. Therefore, the impact of dividends on the ruble payments in '25 will mirror '24's impact.

According to Alexander Potavin, companies will shell out roughly 2.7 trillion rubles in dividends as the dividend season unfolds, easing by mid-summer. By year's end, the need for exporters to repatriate their foreign earnings dwindles.

The Bank of Russia rounds off its report with a 62% increase in net purchases of currency by private citizens, driven by the ruble's surge and the approaching vacation season. Since the start of the year, private individuals have accumulated a healthy sum of 386 billion rubles in foreign currency, significantly less than the same period in '24.

As the ruble continues its triumphant march, investors, global tensions, and the dividend season lay the groundwork for its future performance. With the Bank of Russia cautiously watching for potential rate changes due to inflation, the Russian stock market keeps a careful eye on the ever-evolving ruble landscape.

Want more finance insights? Join our Telegram channel: @expert_mag

Behind the Scenes:

The strengthening ruble has been shaped by several factors, including favorable interest rates, stable economic growth, global economic uncertainties, and easing tensions with the U.S. administration. These elements have boosted investor confidence in the ruble, contributing to its enduring resilience.

On the flip side, the strengthening ruble may lead to a decrease in foreign currency deposits in Russia. Factors like increased confidence in the ruble, higher returns on ruble investments, and economic policies encouraging the use of the ruble could potentially impact foreign currency deposits. However, these reports don't explicitly mention a decrease in foreign currency deposits in Russia – the focus remains on the ruble's performance and the factors contributing to its strength.

In the context of the strengthening ruble, the decreased demand for foreign currency and the increasing popularity of ruble investments among Russian residents hint at a potential decline in foreign currency deposits in Russia. The Bank of Russia's tight monetary policy, favorable interest rates, and economic growth have boosted investor confidence in the ruble, possibly reducing the appeal of foreign currency deposits. However, a clear statement regarding the decrease in foreign currency deposits isn't explicitly provided in the text.