Profitable investment prospect at TUI: potential annual returns reaching 11.91% over an extended duration

Let's Dive into the TUI Equity-Linked Bond

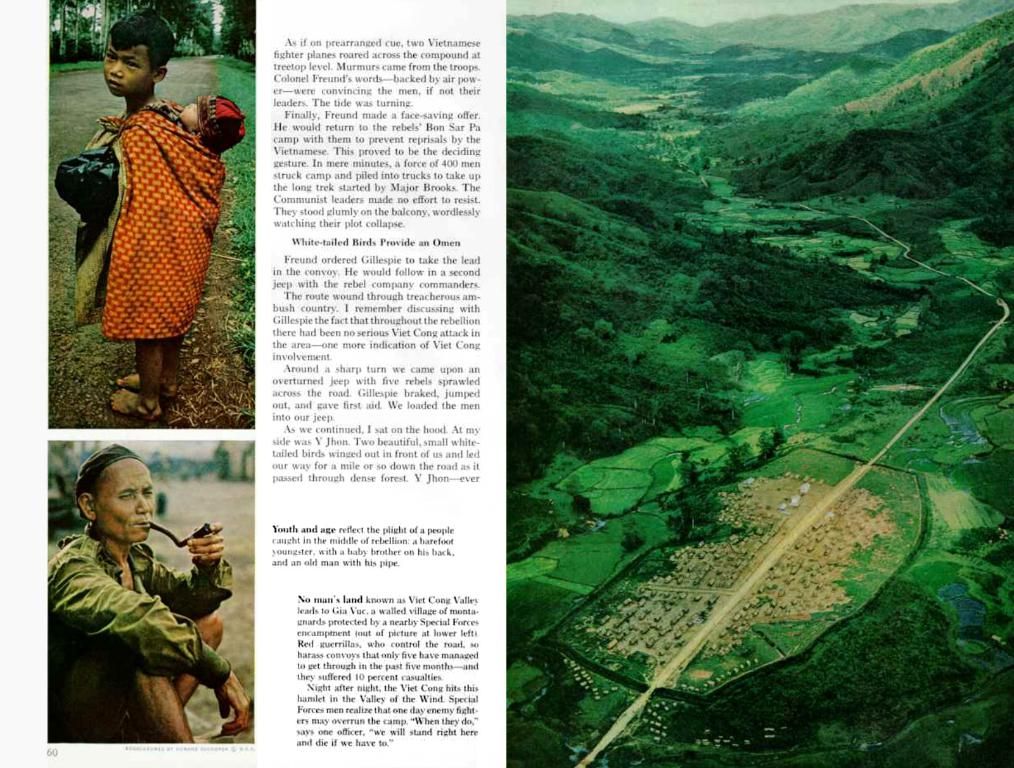

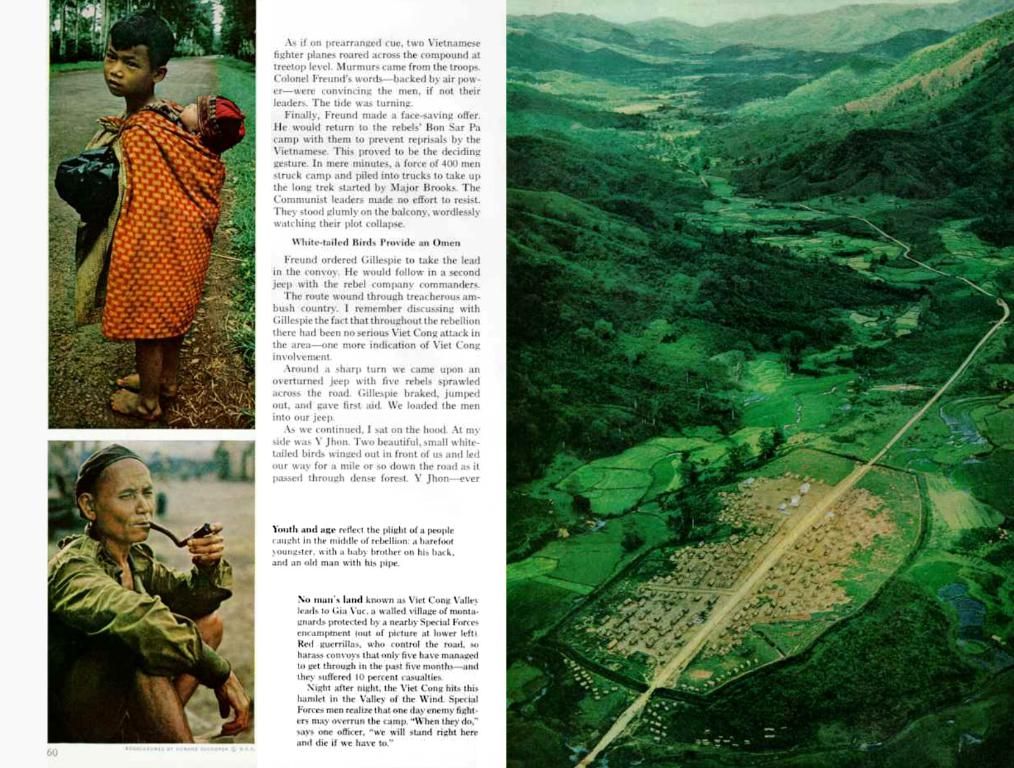

TUI's WKN HT1L3S bond from HSBC offers investors a chance to secure high-interest rates on the TUI stock for two years, up to 11.91% p.a. But, there are conditions! Is this investment worth considering or should you steer clear?

High-Interest Rates Await - But Check the Fine Print!

An equity-linked bond is a unique creature - it's like buying shares in a company, but instead, you purchase a certificate. So, you'll forfeit the dividends and higher returns associated with owning the stock directly. But don't despair! In exchange, you get higher, safer interest rates. But, these rates vanish if the bond's issuer, HSBC, goes belly-up. Other than that, your pockets will be lined with a guaranteed 11.91% interest p.a. for the next couple of years.

Who's This product for?

So, who ought to jump on board this investment train?

By the by: To get your hands on more thrilling investment ideas and expert insights from the BÖRSE ONLINE team, just sign up for our free BÖRSE ONLINE Outperformance Newsletter every Friday. Go ahead and sign up - don't miss out!

To Stock or to Stash Interest?

Want to get your capital back in full, along with that interest? Well, the TUI stock needs to reach, or exceed, the base price of 8.25 euros on the valuation day (18.12.2026). If the stock's price is below the base price on that date, you'll still earn interest, but there's a twist - HSBC explains it themselves: "If the relevant price of the underlying asset is below the base price on the valuation day, the underlying asset will be delivered on the repayment date in the whole number expressed by the conversion ratio. Any fractional parts of the conversion ratio will result in an additional payment."

So, even with those enticing interest rates, you might still come up short. Plus, the profit is capped. This equity-linked TUI bond might be perfect for investors who expect a sideways movement in TUI's stock and are hunting for interest. But, remember, there's always that pesky risk factor lurking around.

For risk-free interest, take a tour of our BÖRSE ONLINE savings account comparison and our BÖRSE ONLINE fixed-term deposit comparison.

And then read: 10 Stocks to Own! 9.55% dividend yield and a P/E ratio of 1.0!, or find out if Warren Buffett was wrong about a stock - now, there's a 100% chance after a sale!

Remember: TUI has nothing to do with the equity-linked bond, and the interest isn't doled out by the travel company. HSBC, the bond's issuer, simply designed a product that ties to the TUI stock's performance.

The securities presented are debt securities. Investors face a substantial risk of capital loss, up to total loss, in the event of price drops in the underlying asset or insolvency of the issuer. To get the full picture about possible risks and product conditions, consult the offering documents (final terms, relevant base prospectus including any supplements, and the registration document or "Prospectus"). These securities are complex products that might be tough to understand.

This investment might suit investors who anticipate TUI's stock will remain stable or Senator, as the interest is contingent on the stock performance. However, for risk-free interest or fixed-term deposits, check out the BÖRSE ONLINE savings account and fixed-term deposit comparisons.