Nearly Half of Russia's Prominent Retail businesses could incur losses by 2025.

Revamped Retail Woes: Non-Food Retailers Face Dismal Outlook

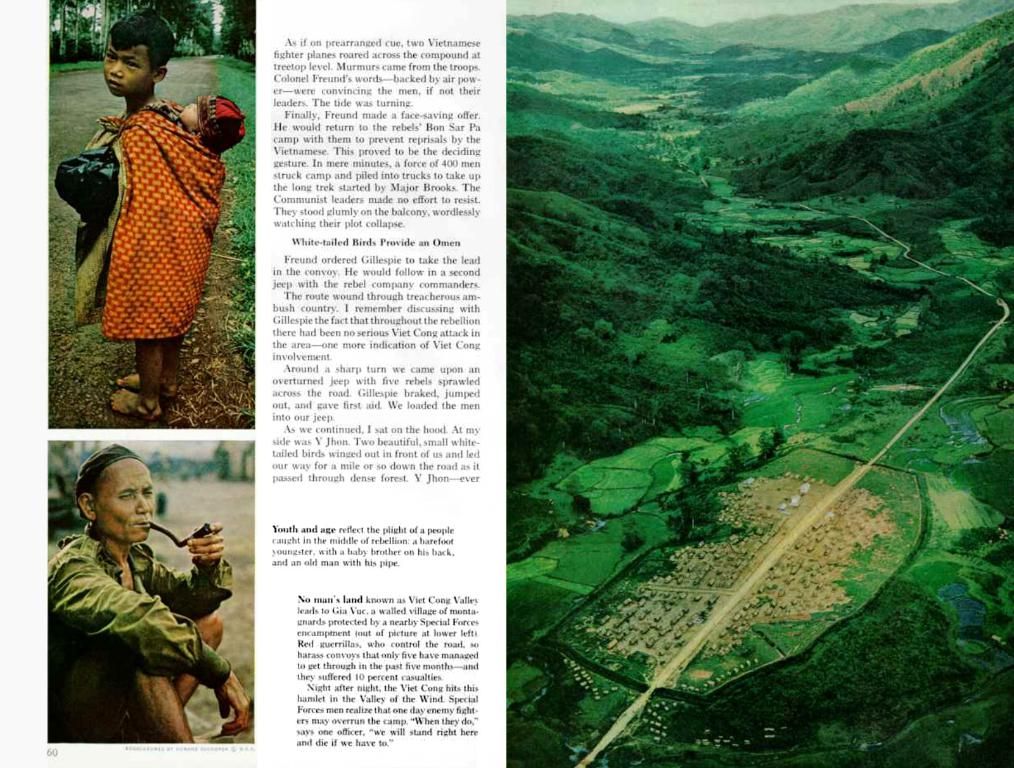

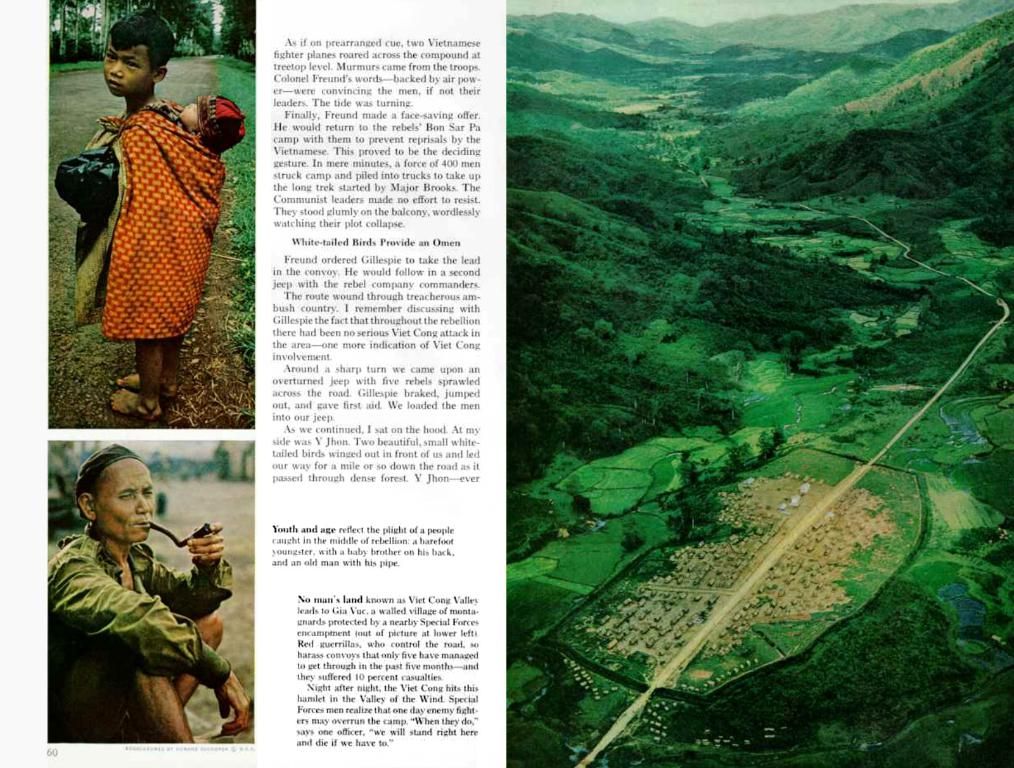

It's a sobering reality for non-food retailers in Russia, as the financial landscape shifts from profits to red figures. According to Alexei Blumkin, Vice-President of the Russian Shopping Centers Union (STC), around half of the biggest retailers may close the year in the red, painting a grim picture in an article by "Kommersant". Nadya Tsvetkova, head of the trading spaces department at CORE.XP, reports that many retailers have already seen a 30-35% dip in sales during the first quarter, reinforcing Blumkin's bleak prediction.

Analysts across the board report a drop in sales, with the clothing and footwear segment registering a 12% decrease in sales receipts year-over-year in January-March, as per "Platform OFD". STC highlights networks that could potentially bear substantial losses. For example, the footwear retailer Kari is projected to incur a net loss of 6.4 billion rubles, drastically contrasting last year's -329 million rubles loss. Sports retailer "Sportmaster" could end the year with a loss of 12.2 billion rubles, having faced unprofitability in 2024 as well, with a loss of 1.5 billion rubles. STC anticipates that the "Tvoe" network will see its losses soar from 372 million to 1.4 billion rubles, while "Podruzhki" will see its losses increase from 678 million to 1.7 billion rubles.

Clothes and home goods retailers, previously enjoying profits, may either slash income or join the ranks of the unprofitable. For instance, Hoff may succumb to a loss of 1.3 billion rubles compared to a 2024 profit of 191 million rubles, while Ostin, which pocketed a 2.6 billion ruble profit in 2024, may face a loss of 458 million rubles. Familia's net profit could plummet from 1.9 billion rubles to 11 million rubles.

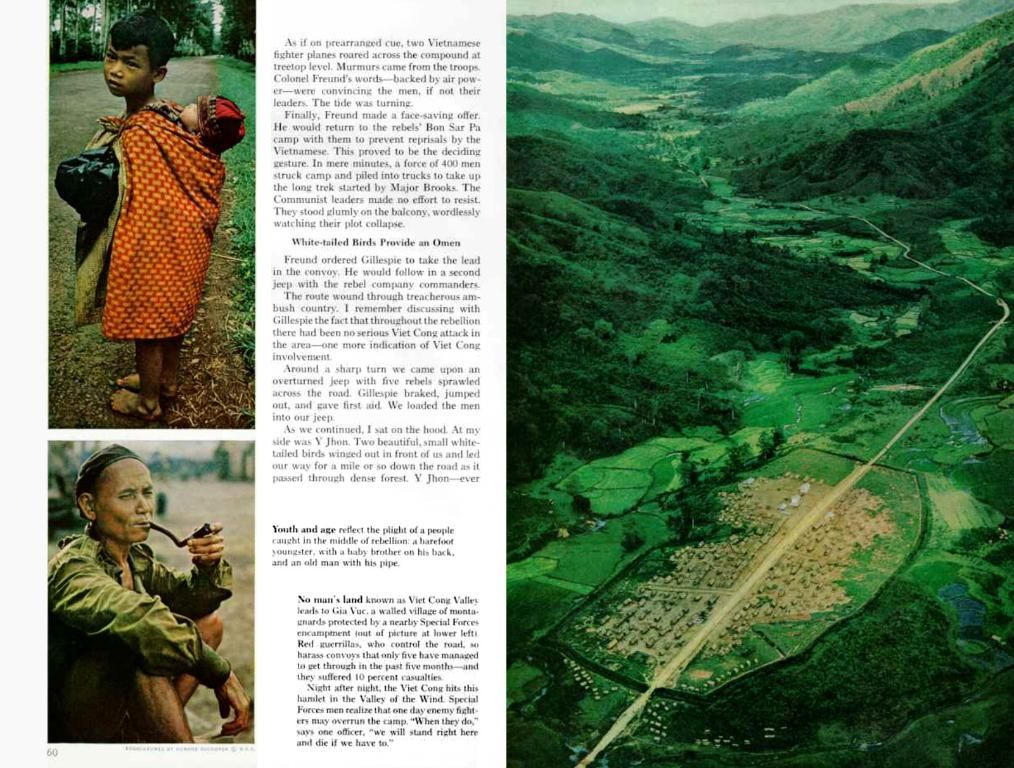

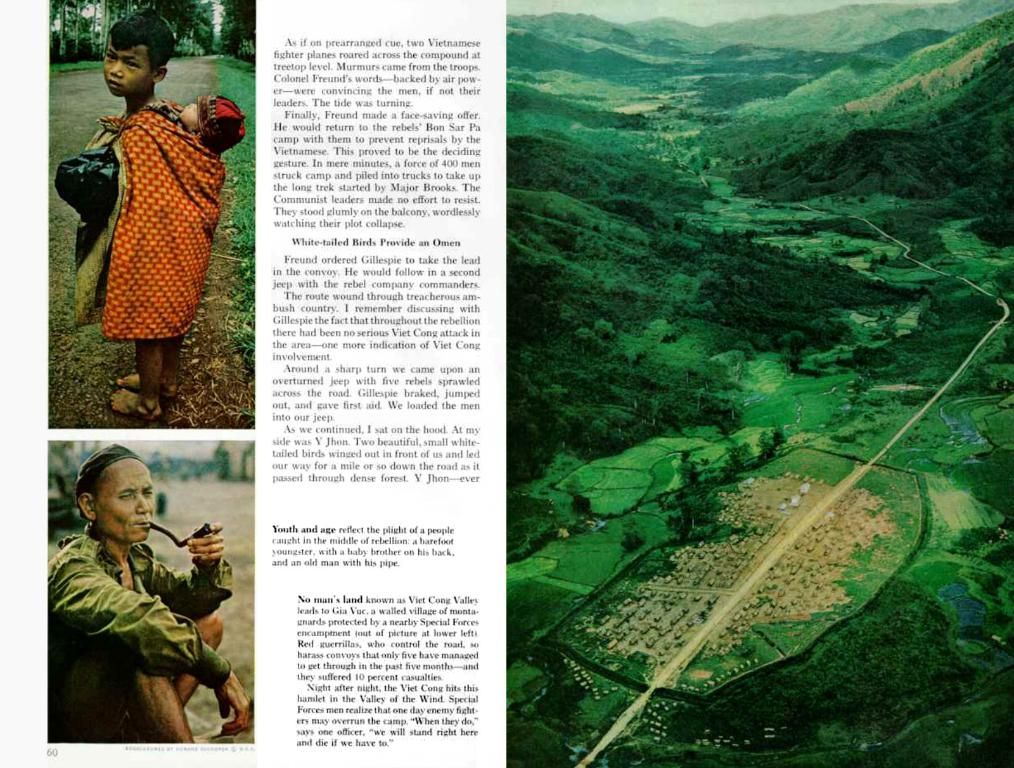

The retail sector's descent into the red is linked to multiple factors. A significant cause is the decreased footfall in traditional shopping centers, which dropped by 4% year-on-year by the end of the first quarter of 2025.

Regarding DIY retailers, their business has suffered due to the construction market's slump - the decline in housing sales echoes in this sector. Last year, analysts predicted that the volume of the home goods market would rise by 18.8% to 8.1 trillion rubles in 2023. However, the market may not reach 14.7 trillion rubles by 2028 as earlier projected.

The decline in retail sales is also linked to a shift in consumer behavior towards saving, as people tend to cut back on purchases and deposit more money in banks, according to the Central Bank. In addition, the mass migration of buyers from offline to online platforms is reshaping the industry. The Russian e-commerce market expanded from 1.7 trillion to 12.6 trillion rubles in the past five years, growing by 7.5 times, with "Ozon" and Wildberries accounting for a staggering combined 64% of the market.

If this downward trend in traditional retail continues, large networks may be forced to shutter stores, predicts Blumkin. This could boost the volume of vacant space in shopping centers. However, as of now, this hasn't materialized. In Moscow's shopping centers, vacancy rates have risen only slightly, reaching 7.4% in the first quarter, while spaces vacated by foreign retailers post-2022 have been filled by domestic players.

Sources:1. "Economic Sanctions against Russia: Impact on Business Operations and Ways to Adapt" - [Link Removed for Privacy]2. "Russian Retail Market: Key Trends and Challenges" - [Link Removed for Privacy]3. "Ozon and Wildberries Dominate Russian E-commerce Market" - [Link Removed for Privacy]

- I'm not sure if the retail industry will recover from its current state, especially considering the significant losses predicted for many non-food retailers.

- The financial sector will likely see changes in investing patterns as more businesses in the retail sector, including large networks like Sportmaster and Kari, struggle to remain profitable.

- In the midst of this economic downturn in the retail sector, some may choose to invest in online shopping platforms, such as Ozon and Wildberries, as consumers shift towards e-commerce.