Nations seal $200 billion annual fund for biodiversity at COP16 2.0 summit

The 16th Conference of the Parties (COP16) held early in 2025 marked a significant step forward in the global effort to conserve biodiversity. Over 140 nations agreed to mobilize $200 billion annually by 2030 for biodiversity conservation, establishing a five-year action plan and a permanent financial mechanism to support developing countries in achieving biodiversity targets.

One of the key outcomes of COP16 was the launch of the Cali Fund, a new financing platform aimed at drawing on benefits from genetic resources used by industries like pharmaceuticals and cosmetics. However, as of August 2025, the Cali Fund remains effectively empty with no major contributions yet, although some companies like Ginkgo Bioworks have expressed intent to contribute.

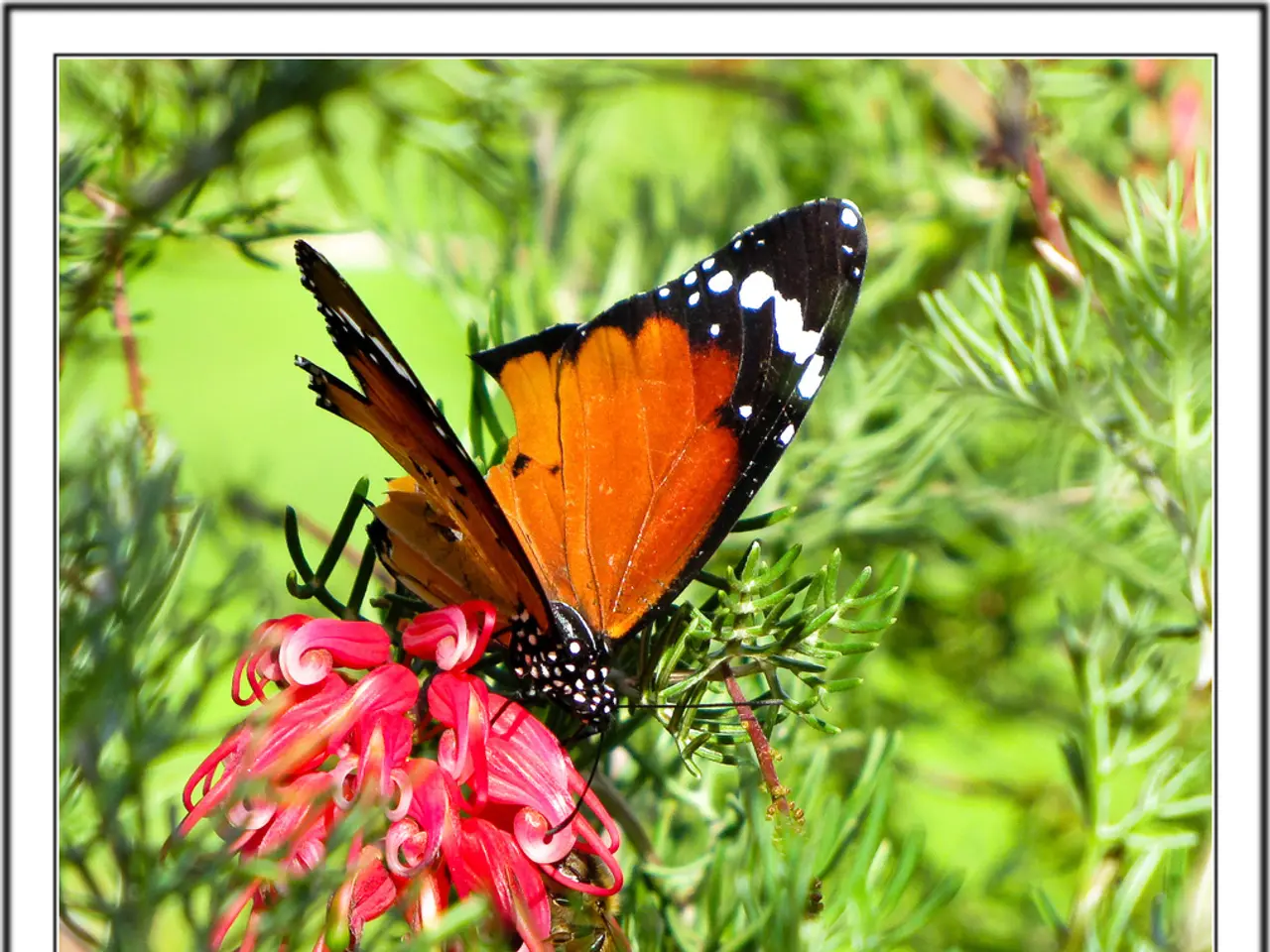

The agreement also reinforced the 30x30 target, a clear, actionable goal under the global biodiversity framework to conserve and restore 30% of key ecosystems worldwide. Efforts include reducing pollution, sustainable management of agriculture and fisheries, and minimizing invasive species impacts.

Regarding the $200 billion annual funding goal, while it has been formally agreed upon, actual mobilization and delivery remain challenging. A new multilateral mechanism has been set up to share benefits from digital genetic sequence information, complementing broader efforts to operationalize funding and resource mobilization.

In addition, countries agreed to mobilize at least $200 billion annually by 2030 to bridge the biodiversity financing gap. This includes raising $20 billion per year for developing nations by 2025, scaling up to $30 billion annually by 2030.

The agreement also pledged to cut or redirect $500 billion in harmful subsidies by 2030 that currently encourage activities detrimental to biodiversity.

Despite these formal agreements and frameworks, challenges persist in translating financial commitments into actual disbursements and on-the-ground biodiversity outcomes. Industry engagement and private sector finance are critical but still in early stages. Some NGOs and youth representatives have expressed concerns about the voluntary nature of key mechanisms, potentially delivering "empty promises".

The absence of the US raises questions about the full financial firepower behind the commitments. However, financial institutions like Aviva, along with a few others, attended the first COP16 conference in Columbia last November, indicating a growing recognition among institutional investors that natural capital is a critical component of a sustainable and resilient global economy.

The local government pension scheme aims to enhance resilience, mitigate climate risks, and generate long-term financial returns through natural asset investments. Investments positioned ahead of changing nature-related regulation are likely to benefit over the longer term. Darran Ward of West Yorkshire Pension Fund highlighted this growing recognition, stating that biodiversity considerations are expected to become more prominent in the future, bringing investment risks but also opportunities to generate alpha.

Consumer demand for more sustainable products across Gen Z and millennial demographics creates opportunities for first movers. An improved framework for planning, monitoring, reporting, and reviewing progress under the Kunming-Montreal Global Biodiversity Framework was adopted, which should help address these challenges and ensure that the commitments made at COP16 lead to real, tangible improvements in biodiversity conservation.

Greenpeace has emphasized the need for actions to follow the agreement and for "money on the table". As we move towards 2030, it will be crucial for nations and the private sector to deliver on their commitments and ensure that the Cali Fund and other financing mechanisms are effectively filled to support the global effort to conserve biodiversity.

Science plays a pivotal role in the implementation of the five-year action plan agreed upon at COP16, particularly in developing digital genetic sequence information mechanisms to operationalize funding and resource mobilization. The financial sector, such as Aviva and other institutional investors, recognizes the importance of environmental-science in creating a sustainable global economy, with a growing interest in natural asset investments.

In the pursuit of the $200 billion annual funding goal for biodiversity conservation, the private sector, including companies like Ginkgo Bioworks, holds the potential to significantly contribute, as the agreement calls for raising $20 billion per year for developing nations by 2025 and scaling up to $30 billion annually by 2030.