LSEG spearheads child identity fraud initiative

Maintaining Trust in the Era of AI-Driven Fraudsters: Perspectives from Pindrop, Anonybit, and Validsoft

In today's digital world, AI is revolutionizing the fraud game, and it's causing quite a ruckus. Here's a rundown of what industry players like Pindrop, Anonybit, and Validsoft have got to say about it:

Pindrop's Take

Fraudsters have upped their game, thanks to agentic AI. They can now sound human, act independently, and launch autonomous attacks on a massive scale. This has led to a spike in deepfake fraud, and Pindrop predicts a whopping 162% increase by 2025![1][2]

These synthetic voice scams are on the rise, and Pindrop has come up with solutions to nip them in the bud. Their tech is designed to recognize and thwart these deepfake-powered scams, keeping businesses from getting duped and preserving customer trust.[2]

Pindrop also banks on voice biometrics toverify identities and sniff outfraudsters using AI-synthesized voices,especially in sectors like finance, where safeguarding high-value transactions is mission-critical.[2][5]

Anonybit's Insight (In Absence of Specific Data)

With limited info available, we can't pinpoint Anonybit's thoughts on the AI-driven trust conundrum. But you can bet they're keeping a close eye on it.

Validsoft's Perspective (In Absence of Specific Data)

Alas, the search didn't turn up any specific insights from Validsoft on this topic. But like the others, they're likely researching and developing strategies to keep digital interactions secure and trustworthy.

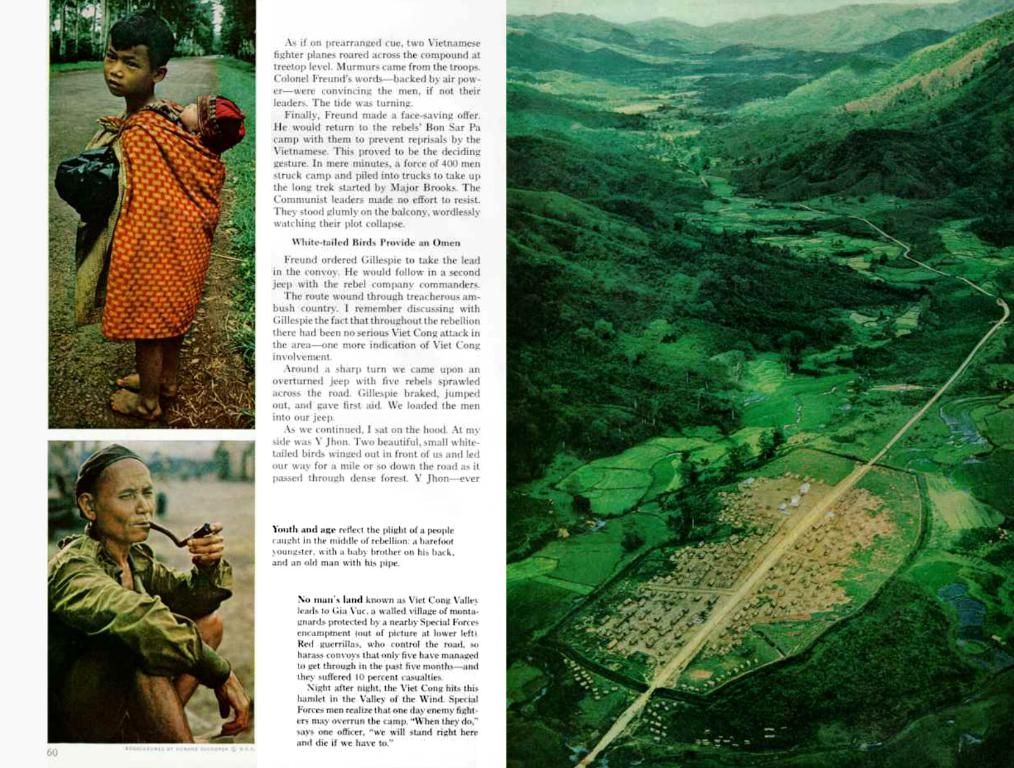

Building Trust in Our AI Age

The rise of agentic AI can be a double-edged sword, as it can easily mimic human voices and behaviors, complicating the task of maintaining trust in digital interactions. Companies like Pindrop are working diligently to combat these threats, emphasizing the need for robust fraud detection and prevention methods to ensure that digital interactions remain secure and reliable.[1][2]

The bottom line is that in the age of agentic AI, trust lies in the integration of advanced technologies and strategic approaches to protect digital transactions from fraud, assuring a secure and dependable digital landscape for everyone.

Businesses need to prioritize implementing robust AI-driven fraud detection and prevention methods to maintain trust in digital transactions, like those in the finance sector, as AI-powered fraudsters are escalating their attacks on a massive scale, leading to an increase in deepfake fraud.

In the race to secure digital interactions, companies like Pindrop are developing innovative solutions to recognize and thwart AI-synthesized scams, thereby preserving customer trust and ensuring the integrity of high-value transactions in sectors such as finance.