Uncovering the Hidden Labor Market: Klingbeil Calls for Aggressive Action against Illicit Work and Promises Enhanced Customs Enforcement

Klingbeil advocates for increased deployment of Black workers to combat issues, proposing customs officers reinforcement.

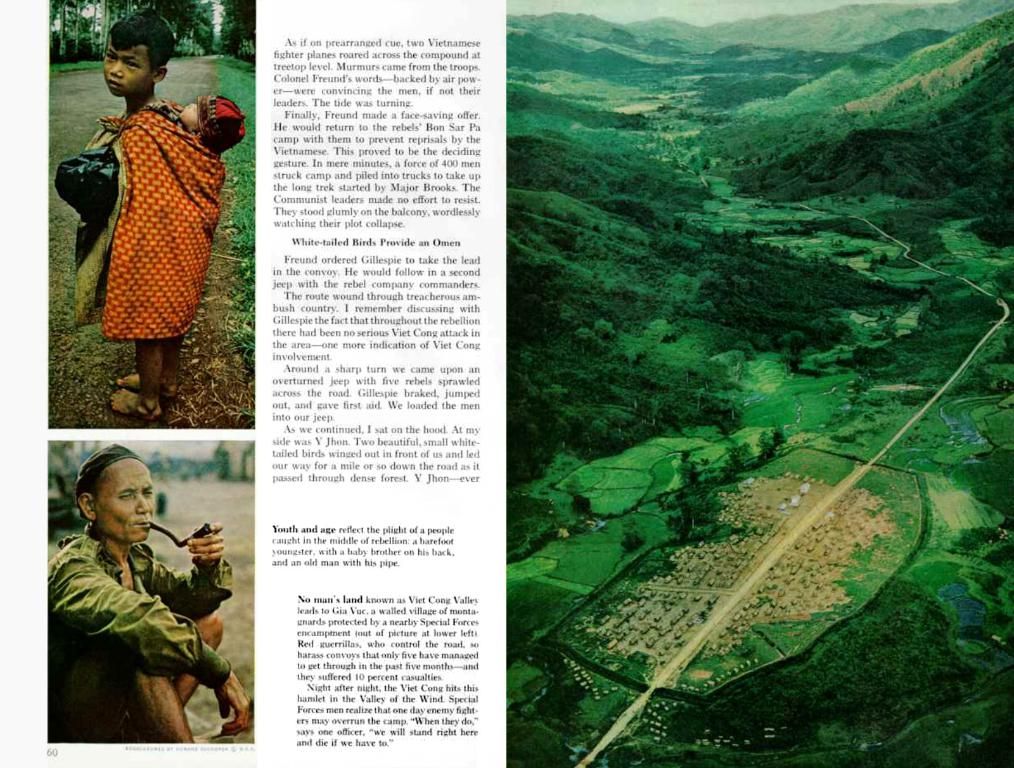

Facebook Twitter Whatsapp E-Mail Print Copy Link Illicit Labor: A Hidden Threat with Major Financial Consequences

In a bold move, Federal Finance Minister and Deputy Chancellor Lars Klingbeil revealed the staggering cost of underground labor to the German economy, amounting to an estimated 766 million euros in 2024. Klingbeil made it clear that intensified investigations would expose even more illicit activities, protect workers from exploitation, and recoup lost state revenues. The SPD politician announced plans to present a bill to combat illicit labor transactions before the summer break.

Economics Kicking out the Cheats: The Shocking Increase in Labor Violations

The alarming rise in damages attributed to illicit labor practices compared to the previous year, 615 million euros in 2023, underscores the growing problem. Industry experts anticipate a much larger "dark figure," indicating the true extent of the issue. Klingbeil expressed the use of advanced technologies, such as artificial intelligence, to analyze financial data and bolster investigations. The primary focus of these efforts will be on sectors like beauty services, such as hairdressing, cosmetics, and barber shops, as well as nail studios.

Economics "Time to Root Out the Problem" - Many High-Earners Embraced the Shadow Economy

Also during a Monday evening event in Lüneburg, Klingbeil embraced a confrontational stance against his predecessor, Christian Lindner, asserting, "I want to send out my customs officers, there's plenty to look at." Lindner was criticized for a supposed lack of ambition concerning state revenue, which Klingbeil emphasized as billions being lost. Despite insufficient personnel resources, Klingbeil believes that customs investigators can be more effectively utilized to combat tax avoidance. He acknowledged that the issue of illicit labor and unlawful employment has long been a concern but vowed to make significant progress in his new role.

Sources: ntv.de, gho/rts/dpa

- Illicit Labor

- Lars Klingbeil

- Federal Ministry of Finance

- Customs Investigators

Enrichment Data:The effectiveness of customs investigations in combating labor transgressions in industries like beauty services remains uncertain. Nevertheless, Germany's strong anti-money laundering regulations may indirectly aid in detecting and disrupting financial activities associated with these illicit activities [2].

Typically, customs investigations focus on goods rather than labor. However, they can form part of broader law enforcement efforts targeting organized crime and illegal activities. Germans authorities have made notable progress in tackling organized crime in areas like drug trafficking and cultural artifact smuggling [1][5]. Nevertheless, the specific influence of customs investigations on the illicit labor market in these sectors requires further research.

To tackle underground labor effectively, the German law enforcement may adopt strategies such as:

- Coordinated Raids and Inspections: Organize regular inspections and raids to identify and prosecute labor violations.

- Financial Investigations: Utilize anti-money laundering laws to monitor and dismantle financial flows linked to illicit labor practices.

- Interagency Collaboration: Collaborate with other law enforcement agencies and regulatory bodies for a holistic approach in combating labor market offenses.

The lack of specific data makes it challenging to evaluate the efficacy of these strategies in the context of the aforementioned sectors without additional information.

- The Federal Finance Minister, Lars Klingbeil, announced plans to use advanced technologies like artificial intelligence to investigate the illicit labor market, particularly focusing on sectors such as beauty services, hairdressing, cosmetics, barber shops, and nail studios.

- Klingbeil also indicated that customs investigators could play a significant role in combating tax avoidance and illicit labor, with a focus on industries that have long been a concern, targeting both organized crime and unlawful employment practices.