FRANKFURT'S ECONOMY BREWING LOWER RATES

Inflation rates within the Eurozone decelerated significantly in May.

The eurozone's inflation took a plunge in May, sinking below the European Central Bank's (ECB) preferred 2% mark, reigniting speculations about another interest rate cut this week.

- Service Sector Easing Consumer Price Increases in Detail ECB's Anticipated Move Beverages and Beauty: The Top Picks for Senior Ladies Business Bites by Taboola

In a nutshell, Eurostat announced that year-on-year consumer price rises eased from 2.2% in April to 1.9% in May,hopping back beneath the ECB's 2% target. Core inflation—excluding volatile energy, food, alcohol, and tobacco—decreased more than expected, dipping to 2.3% in May from 2.7% the previous month.

The ECB is gearing up to deliver its seventh consecutive interest rate cut on Thursday, obliged by President Trump's unpredictable trade policies looming over the eurozone economy. Jack Allen-Reynolds, a deputy economist at Capital Economics, mentioned that this latest inflation data won't significantly impact Thursday's ECB decision. However, he suggested that the case for another cut in July is more robust.

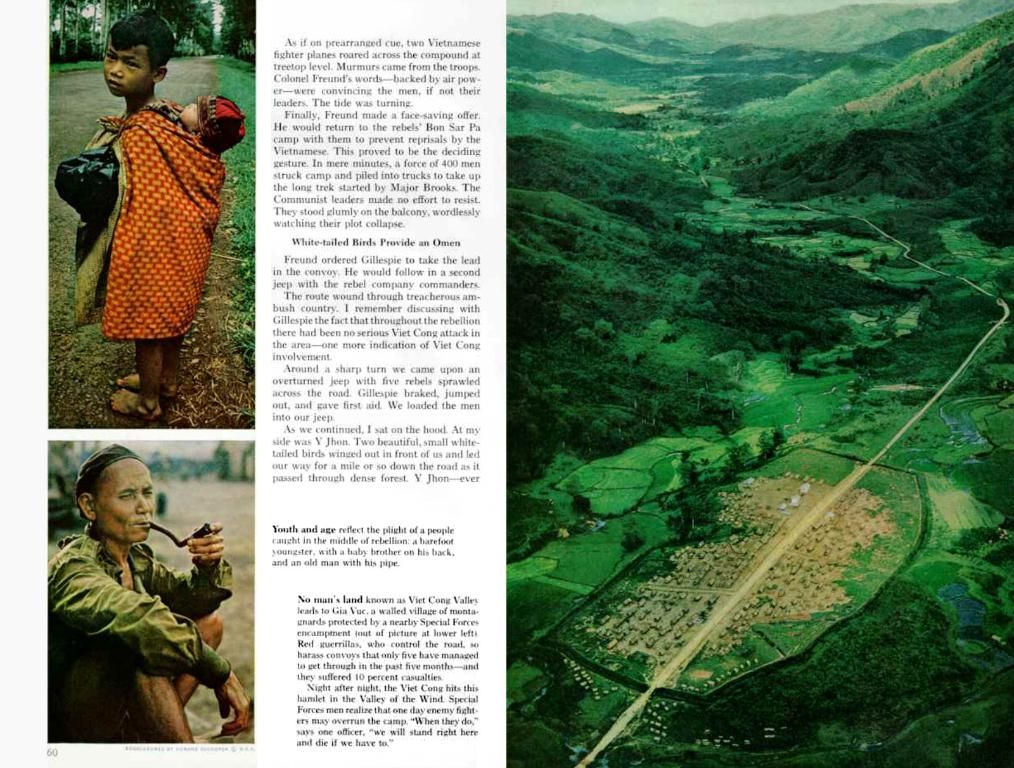

Eurozone inflation reached its lowest point since September 2024, when it stood at 1.7%. Price reductions in the services sector were responsible for the drop, easing from 4.0% to 3.2% in April, according to Eurostat.

Core inflation is a crucial indicator for the ECB, as it strongly correlates with wage growth. The ECB fears that spiraling wages and prices could create a vicious cycle, making it challenging to control inflation.

The energy sector posted a negative rate of 3.6%, remaining unchanged from April. Meanwhile, food price inflation spiked to 3.3% last month from 3.0% in April.

Analysts predict that inflation will continue to fall over the upcoming months, escorting the headline rate well below 2% during the second half of the year. Lower oil prices, combined with a stronger euro, will drive energy inflation down. Meanwhile, cheaper production inputs and imports will curb wage growth and bring down inflation in the services category.

Germany and France, Europe's two economic powerhouses, experienced a slowdown in consumer price increases in May, reporting figures of 2.1% and 0.6%, respectively. The eurozone's overall GDP expanded by 0.3% in the first quarter of 2025 compared to the previous quarter. However, Trump's trade policies have clouded the economic outlook for the eurozone, creating uncertainty in the region.

Trump has suspended 50% tariffs on EU goods until July 9, but a 10% levy remains, alongside 25% tariffs on steel, aluminum, and auto imports. In addition, Trump is planning to raise duties on steel and aluminum to 50%.

Firms operating in the business sector might witness a potential improvement in financial performance due to the anticipated lower interest rates by the European Central Bank (ECB). As the ECB considers another interest rate cut this week, a decline in borrowing costs could stimulate economic activity and investment within the finance sector of the eurozone.

Lower inflation rates and a decrease in consumer price increases could translate into reduced operational costs for companies across various industries, thus improving overall financial health and boosting profits in the business community, including the finance sector.