In a surprising twist, the notorious short seller Hindenburg is reportedly calling it quits.

Tossing their hat into the ring, Hindenburg Research calls it quits after causing quite a stir. Founder Nathan Anderson, famous for tackling giants such as Indian tycoon Gautam Adani's conglomerate and electric vehicle startup Nikola, declared on their website that the time had come to hang up the gloves. "Once we've finished executing our pipeline of ideas, we'll be done," stated Anderson. "AND THAT DAY IS TODAY."

The grind at Hindenburg was no walk in the park; Anderson described it as "an intense, sometimes all-consuming" endeavor, which, he admitted, left him feeling detached from the world and the people he cared about most. "I now view Hindenburg as a chapter in my life, not its defining factor."

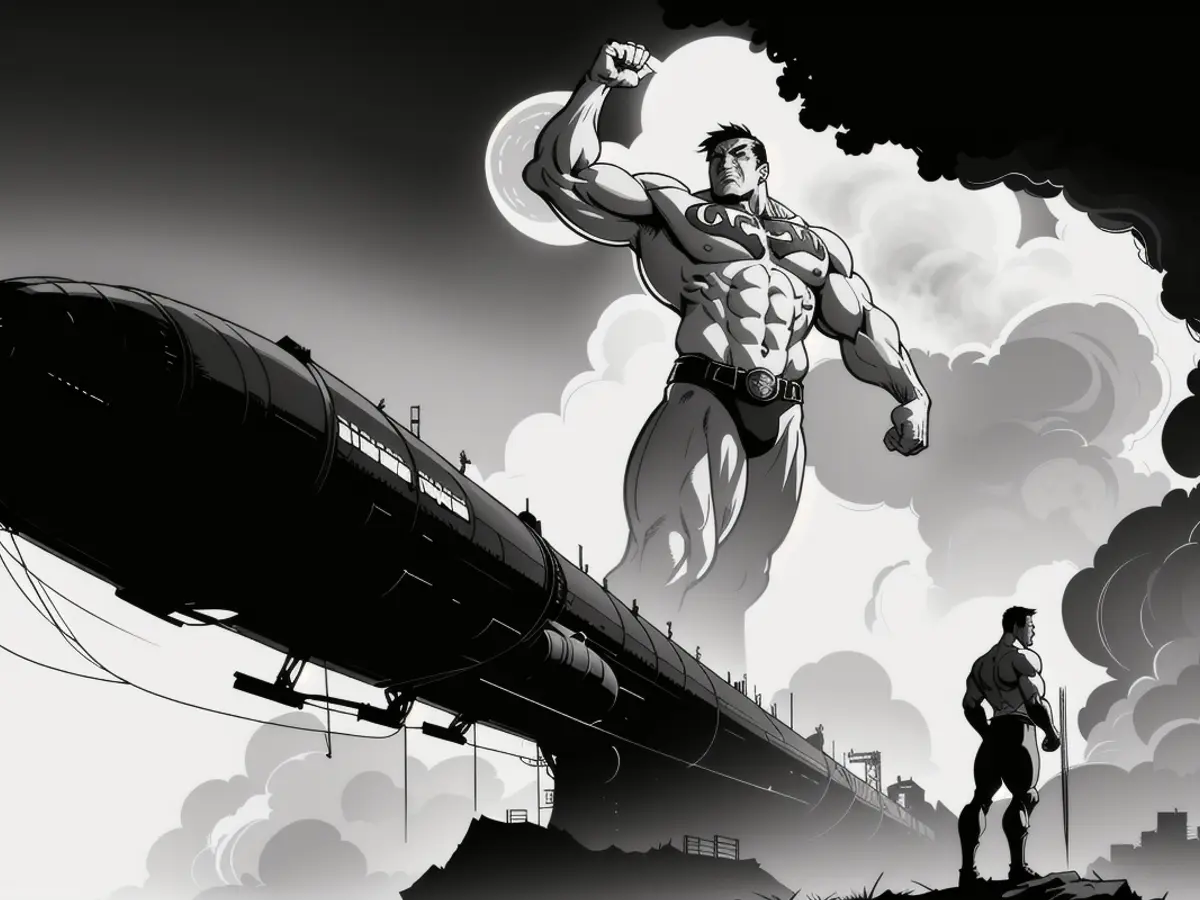

Born eight years prior by Anderson himself, Hindenburg Research was christened after the illustrious German zeppelin "Hindenburg," which infamously burst into flames upon landing in New Jersey back in 1937. The firm's mission statement was clear: they aimed to identify and expose "man-made disasters" in the form of accounting irregularities, mismanagement, and secret stock deals from company executives and boards. Despite the fact that their funds never relied on investor capital, they operated solely on the foundation of Anderson’s own investment.

Short-selling is Hindenburg's weapon of choice; they borrow shares from companies they believe will inevitably come crashing down in value, then sell these shares in the open market. They then cash in by purchasing these same shares back at a discounted price before the loan expires. If the short attack proves fruitless, the consequences can be catastrophic.

Rattling the Royalty

Hindenburg's critical report on the Adani Group in 2023 whipped up a significant storm. The group spent a crippling $100 billion in market value over the course of just a few months due to Hindenburg's allegations of shady accounting practices and illicit use of tax havens. Adani strongly refuted the accusations, but a subsequent investigation by US authorities saw Gautam Adani charged with fraud and bribery, securing a place on the roster of the world's most infamous billionaires. Upon hearing of Hindenburg's departure, shares of several Adani companies bounced back with surprising vigor.

"We've shaken up some empires that cried out for shaking up," Anderson boasted. His vigilant work had resulted in 100 individuals being held accountable for their misdeeds, thanks in part to the attention he garnered from his investigations. Hindenburg's quest for justice found itself in the crosshairs of electric truck manufacturer Nikola in 2020. Hindenburg accused the startup of misleading investors about their technological advancements, prompting a plunge in the company's stock value. The US government took up the case, ultimately convicting founder Trevor Milton of fraud.

[1] Longreads, N. (2023, February 10). Hindenburg Research's Campaign Against the Adani Group. Longreads.[2] ZeroHedge, N. (2020, September 14). Hindenburg Research Accuses Nikola of Fraud, and the Market Reacts. ZeroHedge.[3] Hindenburg Research Website, N. (2023, March 10). Hindenburg Research Announcement. Hindenburg Research Website.[4] Hindenburg Research, N. (2023, March 10). Farewell Letter: Hindenburg's Final Step. Hindenburg Research.

The grind at Hindenburg Research, with its mission of exposing 'man-made disasters' on Wall Street, often left founder Nathan Anderson feeling detached from his personal life. Despite causing a significant stir with their critical report on Wall Street giant Gautam Adani's group, leading to a $100 billion loss in market value, Hindenburg Research chose to close operations, marking the end of their Wall Street crusade.