Finance mobilization in Kazakhstan by AIIB aimed at addressing the infrastructure deficit

Rewritten Article:

Partnering for Progress: Mobilizing Private Capital in Asia's Infrastructure Boom

ASTANA - Bridging Asia's colossal infrastructure financing gap requires the concerted efforts of development banks, investment firms, and government agencies, as discussed during a lively debate hosted by the Asian Infrastructure Investment Bank (AIIB) and Kazakhstan's Ministry of National Economy at the Astana International Financial Centre on April 29.

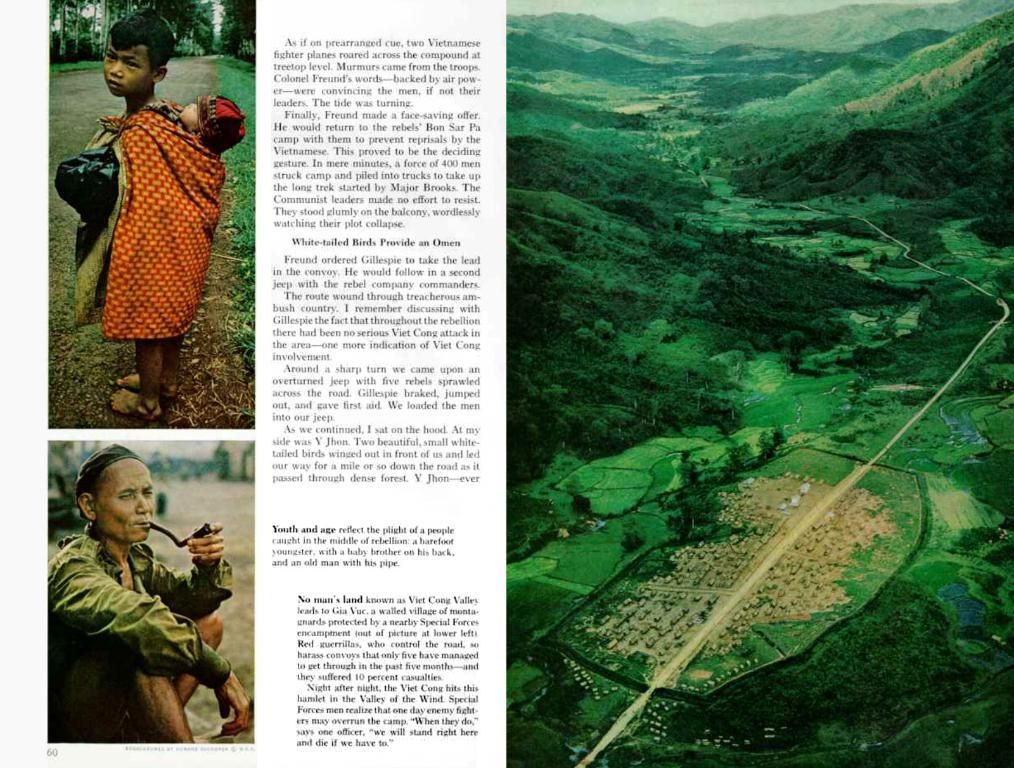

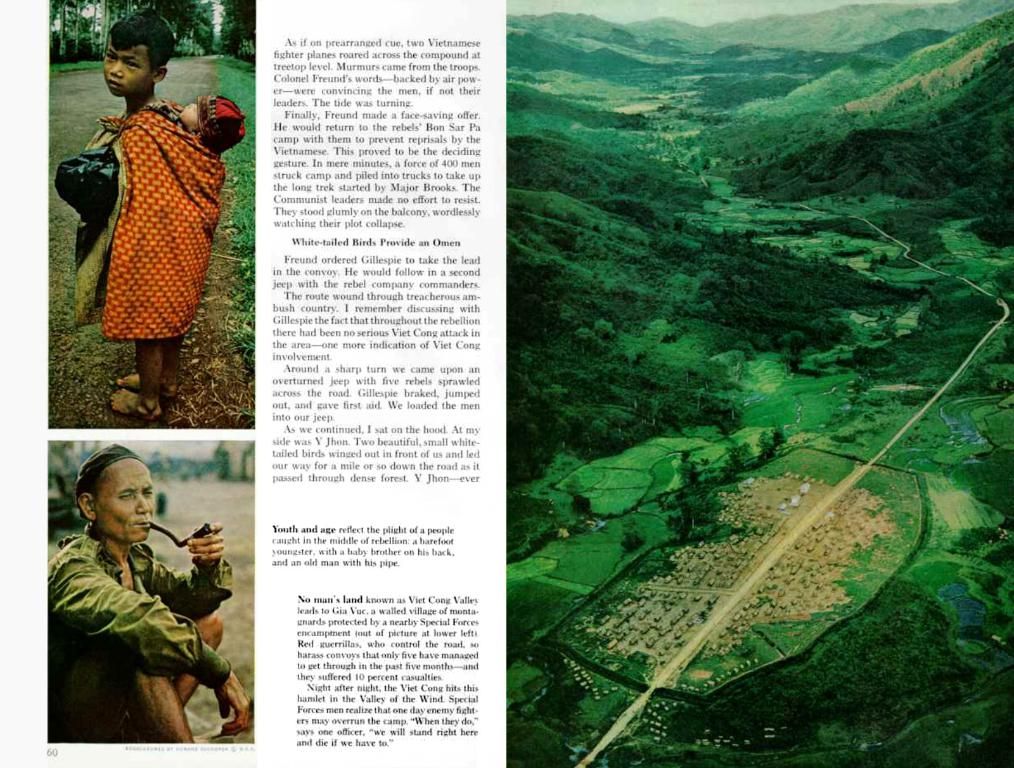

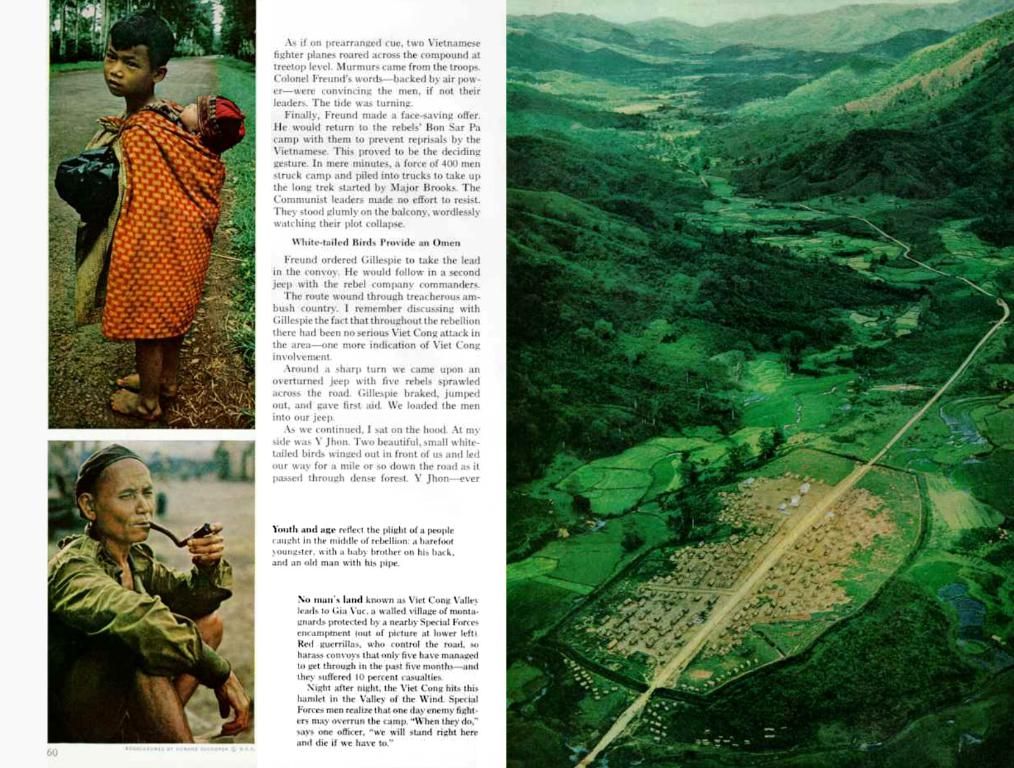

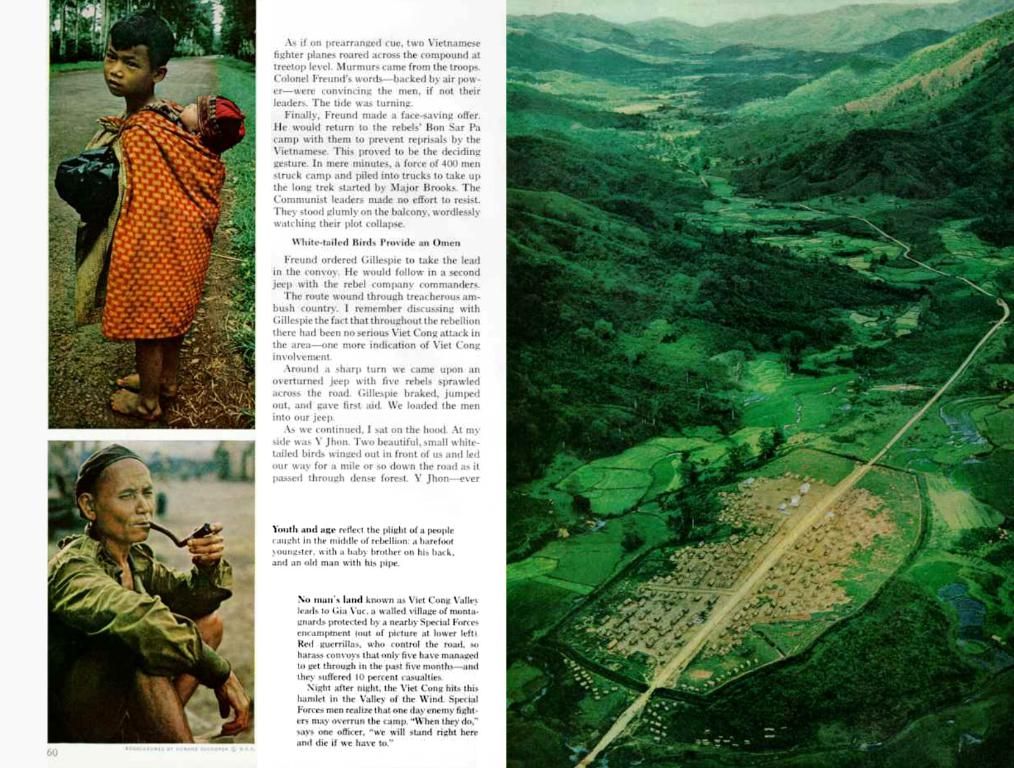

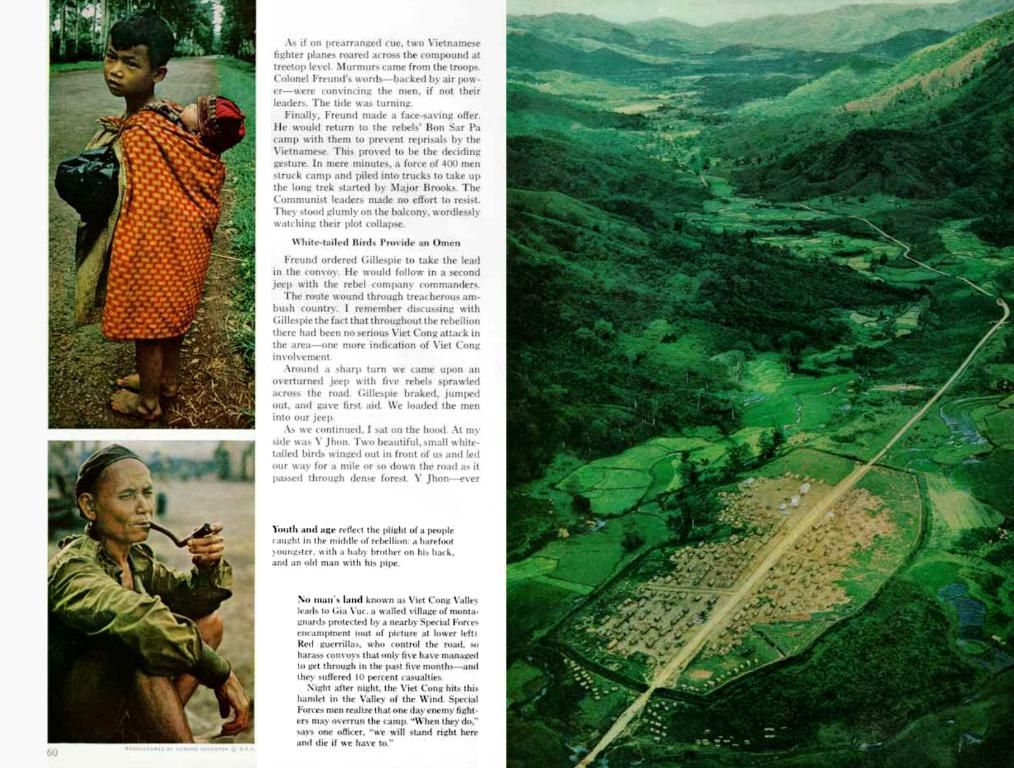

From left to right: Akzhol Urazalin, Evgeniya Bogdanova, Zamira Sundetova, Asim Rana, Nikoloz Gagua, Wang Xianming. Photo credit: Nagima Abuova / The Astana Times

Putting Kazakhstan on the Map: Infrastructure Development as a Catalyst for Growth

The session commenced with inspiring words from Konstantin Limitovskiy, an experienced chief investment officer at AIIB, who shared his optimism for Kazakhstan's strategic role in the bank's portfolio. With Kazakhstan, a founding member of the AIIB, receiving over $2 billion in investments for seven major projects across road networks, renewable energy, hospitals, and more, Limitovskiy urged a continued focus on sustainable and transformative projects.

"These achievements are not mere numbers - they represent the improvement of communities' lives by bringing them closer, powering homes with renewable energy, and providing essential healthcare facilities," said Limitovskiy.

He emphasized AIIB's commitment to supporting Kazakhstan's goal of achieving carbon neutrality by 2060. "Thus far, we have added 420 megawatts of green energy to Kazakhstan's landscape - and it's just the beginning," he noted, citing wind farm collaborations and the financing of the country's first hospital under its public-private partnership (PPP) law.

Railway bypass projects and infrastructure initiatives aimed at eliminating trade bottlenecks, enhancing regional connectivity, and expanding access to essential services were added to the list of ongoing projects. "Join us in changing the world in a positive way, as we gather at the AIIB's 10th annual meeting in Beijing this June," Limitovskiy invited stakeholders.

Hitting the Ground Running: Government Priorities and Off-Budget Funding

Transportation Vice Minister Talgat Lastayev highlighted Kazakhstan's commitment to building a cutting-edge transport infrastructure supported by state development programs extending through 2030. With over 4,000 kilometers of roads slated for reconstruction or construction at a cost of more than $15 billion, Lastayev underscored sustainable infrastructure development and clean energy as vital aspects of the country's ambitious national vision.

Apart from priority transport corridor projects like the Karagandy-Zhezkazgan and Aktobe-Karabutak-Ulgaisyn routes, Lastayev announced updates on upcoming co-financing agreements with the World Bank and European Bank for Reconstruction and Development (EBRD).

Building Momentum: Diversifying Investment, Partnerships, and Regulatory Frameworks

Evgeniya Bogdanova, CEO of the Astana Financial Services Authority (AFSA), guided the discussion towards the pivotal role of sustainability in capital markets. "While infrastructure construction is crucial, enabling opportunities—through the right regulatory frameworks, risk management tools, and market incentives that reward sustainability—matters just as much," she contended.

Bogdanova called for a pronounced role for the private sector in infrastructure development, stressing the need for regulatory certainty, risk mitigation, and financial instruments tailored to long-term investor goals.

She also touched upon AFSA's efforts to nurture an environment conducive to sustainable products and environmental, social, and governance (ESG) instruments. "Multilateral development banks such as AIIB are indispensable partners in this pursuit," she said.

Unleashing the Power of Leverage: Cultivating Private Capital and Promoting Win-Win Scenarios

Asim Rana, AIIB's manager for financial institutions and funds clients, shared AIIB's strategies for mobilizing private capital—a leading strategic priority for the bank.

Beyond direct investments in roads and solar farms, Rana explained how AIIB collaborates with financial intermediaries, such as banks and asset managers, to amplify impact. He skillfully described on-lending facilities, through which capital flows through local banks to fund numerous infrastructure projects under stringent environmental and social standards.

Rana discussed the launch of Bayfront, a collateralized loan obligation (CLO) vehicle in Singapore, and similar initiatives in Hong Kong—with a mission to trade infrastructure loans as securities. "Through such initiatives, we foster liquidity in the sector, recycle capital, and make infrastructure projects more economically viable," he said.

Scaling Impact: Kazakhstan's Development Goals and Challenges

Providing a broader economic outlook, Akzhol Urazalin, a deputy director of the International Economic Cooperation Department at the Ministry of National Economy, detailed Kazakhstan's impressive GDP growth of 4.8% in 2024, led by agriculture, transportation, and manufacturing.

He mentioned that Kazakhstan's national infrastructure plan, spanning 2029, is valued at approximately $80 billion and encompasses over 200 projects in energy, transport, digital, and sanitation sectors. "Close to 90% of this investment will come from off-budget sources," Urazalin revealed.

Urazalin also shed light on the importance of public-private partnerships, mentioning ongoing reforms to boost transparency, tax policy, and institutional frameworks. Despite progress, Urazalin recognized ongoing challenges in long-term financing for the private sector and building robust legal mechanisms for public-private partnerships.

"Our aim is to develop flexible risk-sharing models between the government and the private sector, and to promote the use of green financial instruments," Urazalin stated.

Alignment, Ambition, and Action: private sector partnerships in infrastructure development

Zamira Sundetova, SkyBridge Invest CEO, provided a private sector perspective on the role of asset managers in long-term infrastructure development and emphasized the company's dedication to contributing to Kazakhstan's commitment to carbon neutrality by 2060.

Sundetova highlighted growing investor interest in renewable energy and digital infrastructure, particularly fiber optics and 5G, driven by national priorities and regional demand. She also noted the significance of sustainability, financial resilience, and environmental impact as the main factors considered in the long-term selection of infrastructure projects.

Sundetova championed the idea of establishing a joint infrastructure investment fund, drawing inspiration from the Three Seas Initiative in Europe.

Commercial banks as catalysts for growth: embracing the ecosystem approach

Wang Xianming, a senior executive officer at China Construction Bank's (CCB) Astana branch, emphasized the bank's immense $1 billion investment in Kazakhstan since 2019, focusing mainly on gas, solar, and wind infrastructure.

"In supporting infrastructure development, commercial banks play multiple roles, including financing supporter, risk manager, and ecosystem builder," Wang posited.

Wang elaborated on the bank's adoption of green finance structures, cost reduction through cross-border cooperation, and syndicated loans in partnership with multilateral banks. He underscored the necessity of fostering greater collaboration among banks, asset managers, insurers, and government entities to develop diversified financing systems.

"By pooling our expertise, we can ensure that our partnerships have a lasting impact and grow intrinsic value," Wang concluded.

The Power of Collaboration: Key Takeaways and The Path Forward

In the face of Asia's immense infrastructure financing gap, the panel provided inspirational insights into unlocking private capital through strategies like on-lending facilities, public-private partnerships, green energy financing, and diversified financing systems.

The enrichment data outlined the following significant takeaways for maximizing the impact of infrastructure investment:

- Utilize on-lending facilities to mobilize private capital efficiently while tapping into local market knowledge.

- Embrace public-private partnerships with structured risk-sharing models, as they foster attractive investment opportunities.

- Support renewable energy projects to attract climate-focused investors, aligning with national carbon-neutrality goals.

- Encourage commercial banks to act as financial supporters, risk managers, and ecosystem builders to increase their involvement in infrastructure development.

- Foster cross-border cooperation among governments, development banks, commercial banks, and other financial institutions to establish large-scale green energy projects like the Caspian Green Energy Corridor.

- Adopt blended finance strategies, combining concessional funds with private capital to reduce risks and improve project bankability.

- Nurture a regulatory environment that incentivizes long-term investment, focusing on sustainability, risk mitigation, and market-based incentives.

- Develop flexible risk-sharing models between the government and the private sector to promote the use of green financial instruments and attract private investment.

The panel confirmed the need for diversified financing systems, inter-agency cooperation, and the participation of banks, asset managers, insurers, and governments to ensure the success of infrastructure projects and communities' progress.

- The Asian Infrastructure Investment Bank (AIIB) and Kazakhstan's Ministry of National Economy have collaborated to attract over $2 billion in investments for various projects in Kazakhstan, marking a significant addition to the country's finance for business, infrastructure, and sustainability.

- Konstantin Limitovskiy, an experienced chief investment officer at AIIB, emphasized AIIB's commitment to supporting Kazakhstan's goal of achieving carbon neutrality by 2060, with projects like the financing of the country's first hospital under its public-private partnership (PPP) law and the addition of 420 megawatts of green energy to Kazakhstan's landscape.

- Evgeniya Bogdanova, CEO of the Astana Financial Services Authority (AFSA), called for a pronounced role for the private sector in infrastructure development, stressing the need for regulatory certainty, risk mitigation, and financial instruments tailored to long-term investor goals to ensure successful business ventures.

- Asim Rana, AIIB's manager for financial institutions and funds clients, highlighted strategies for mobilizing private capital by partnering with financial intermediaries, such as banks and asset managers, to amplify impact and create win-win scenarios for both investor and stakeholder communities.