Exploring 2025: Rudi Vizental, Head of ROCA Investments, voices his standpoint on private equity, financial obstacles, and potential advancement prospects in Romania

As the economic landscape in Romania becomes increasingly complex, Rudi Vizental, CEO of ROCA Investments, dishes out his insights on the private equity sector's evolution and the key factors shaping business in 2025.

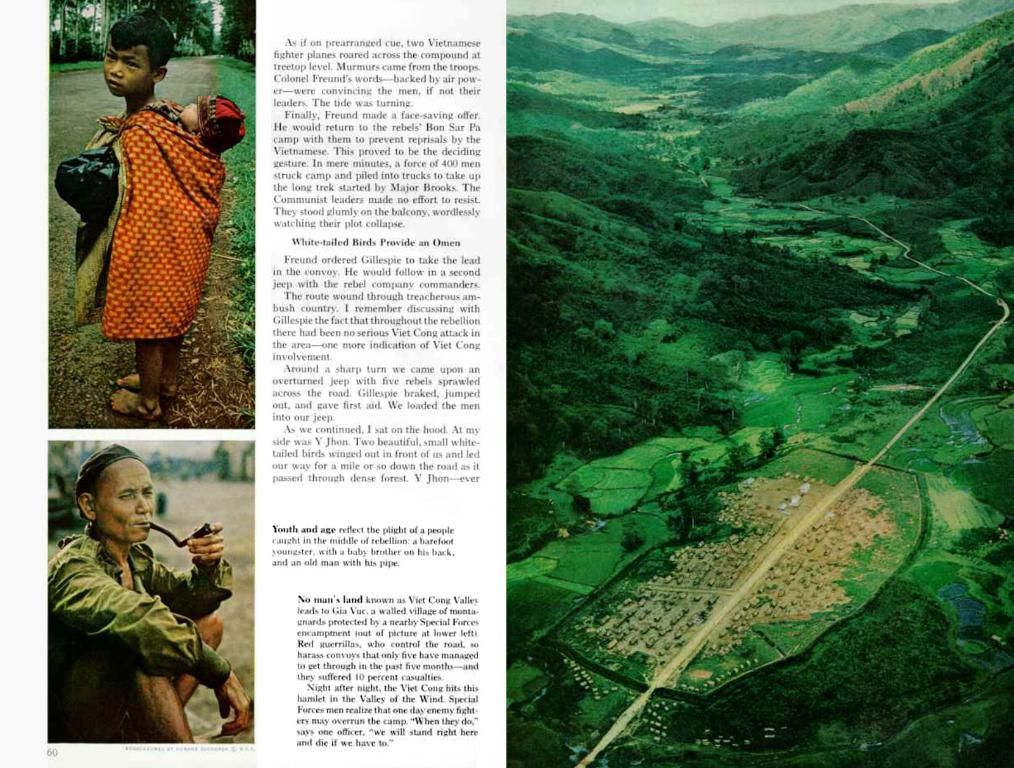

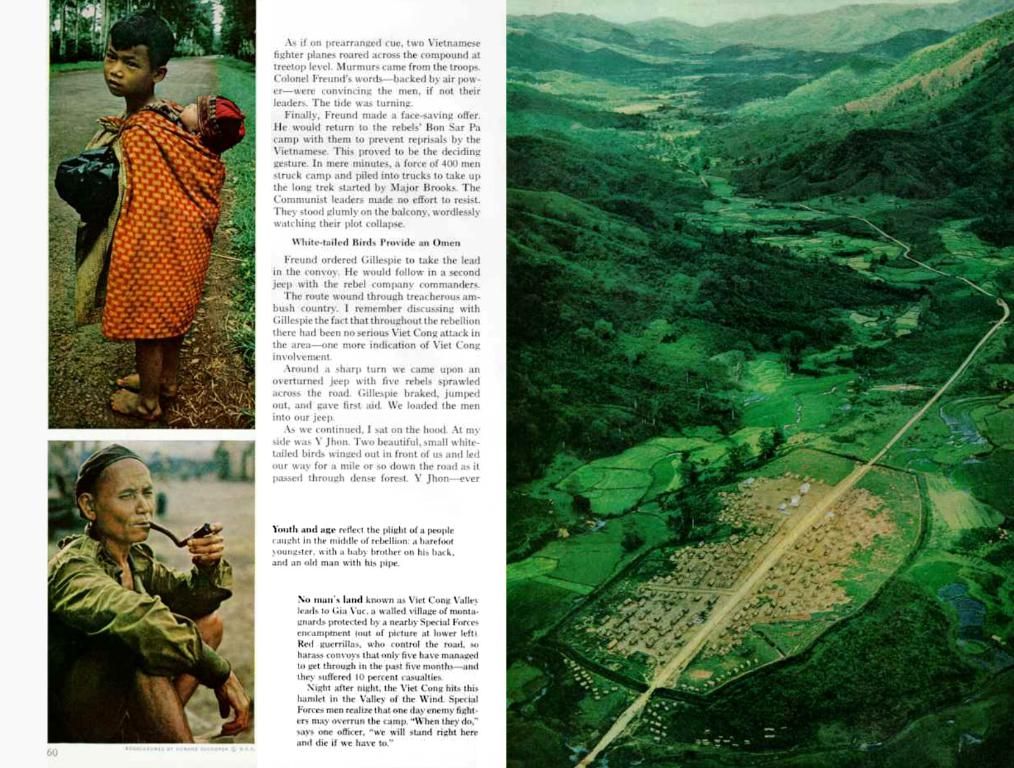

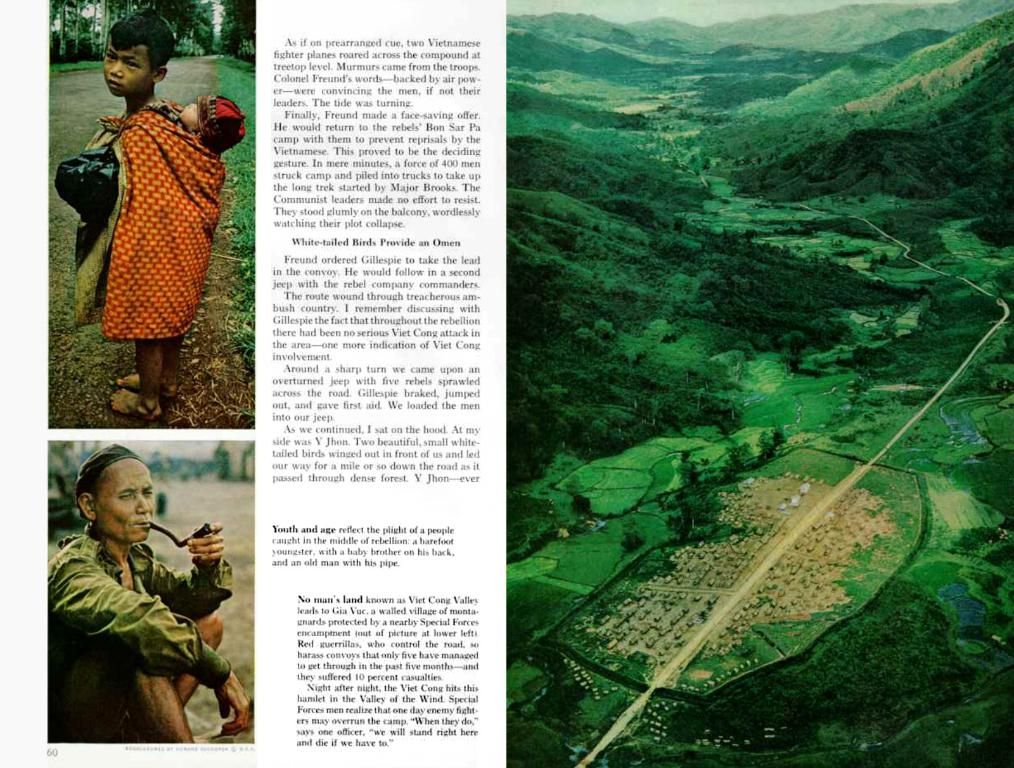

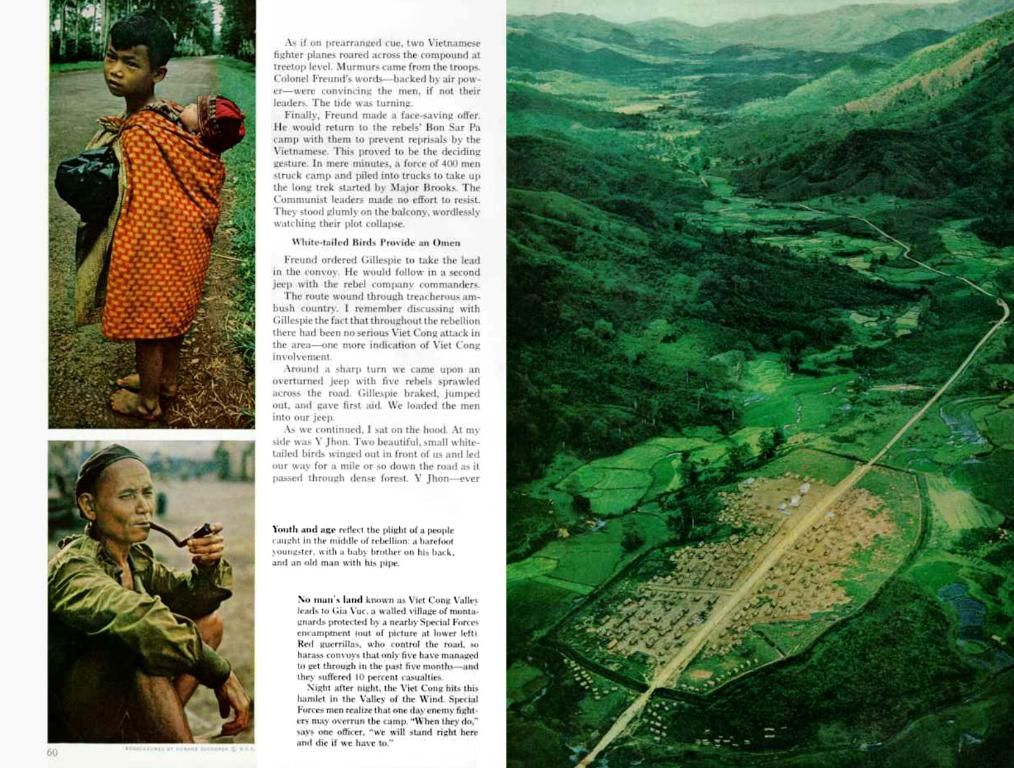

He emphasizes the growing prominence of debt financing and secondary transactions as viable alternatives to traditional funding, stating that "debt financing is stepping in to compensate for banks’ gradual withdrawal from traditional lending, driven by tighter regulations and rising capital costs."

Vizental also stresses the importance of Romania improving its investment climate by aligning legislation with international standards and fostering local institutional investor participation. If not, he cautions that "Romania will not attract substantial international interest from major private equity players." Looking ahead, he believes that private equity firms need to strike a balance between strategic adaptability and disciplined execution, focusing on liquidity, risk management, and digital transformation.

Beyond the private equity sector, Vizental identifies crucial economic inflection points for Romania, including higher taxes, political instability, and a slowdown in traditional financing. However, he also sees potential for growth in the context of Ukraine's reconstruction, which he describes as a significant economic opportunity for Romanian businesses in construction, logistics, and services. His advice to entrepreneurs? Stay agile, prioritize operational efficiency, and expand into emerging markets that offer long-term growth opportunities.

Read the full interview below:

What will be the evolution of the private equity market in 2025, both locally and regionally, given today's complex economic environment?

Rudi Vizental: In the regional landscape, a growing scarcity of liquidity has led to the popularity of two types of products: debt financing and secondary transactions. The former compensates for banks' gradual withdrawal from traditional lending, while the latter facilitates faster portfolio rebalancing and often offers discounted exits.

As for Romania, the market is expected to expand but may not catch up with more developed economies in the sector.

What steps should local policymakers take to make Romania more attractive for private equity activity?

Rudi Vizental: By aligning legislation with international standards, encouraging local institutional investors to allocate capital to this sector, and using funds available via the National Recovery and Resilience Plan (PNRR) to support private equity-backed local companies, policymakers can create an environment conducive to attracting international private equity interest.

How will private equity firms adapt to the new economic context?

Rudi Vizental: Private equity firms will be strategic and disciplined as they navigate economic uncertainty, focusing on capital allocation, liquidity management, risk mitigation, digitalization, and growth opportunities in emerging markets, particularly in the context of Ukraine's reconstruction.

What mindset will you bring into 2025?

Rudi Vizental: In 2025, ROCA Investments will approach investments and portfolio management with adaptability and a focus on execution, staying agile amidst market volatility and fiscal shifts, applying robust risk management and digitalization strategies, and prioritizing operational efficiency and innovation to drive sustainable, long-term growth.

What challenges and opportunities will Romania face in 2025?

Rudi Vizental: Romania will encounter several economic inflection points in 2025, including political instability, higher taxes that may curb investment and consumer spending, and the challenge of securing traditional financing. On the other hand, the region's geopolitical complexities, particularly Ukraine's reconstruction, may create economic opportunities for Romanian companies in construction, logistics, and services.

What are your expectations for the local business environment in 2025?

Rudi Vizental: In 2025, the business landscape in Romania will present both significant challenges, such as a labor shortage and higher taxes, and opportunities, including international expansion and investments in operational efficiency and digitalization.

How optimistic will entrepreneurs be in 2025 compared to 2024?

Rudi Vizental: Regardless of economic conditions, entrepreneurs are inherently optimistic individuals, always seeking opportunities before dwelling on risks. Optimism does not mean ignoring a potential recession but believing that one can navigate it successfully and emerge even stronger.

What advice would you give entrepreneurs for 2025?

Rudi Vizental: Acknowledge that the past, present, and future are not linear but form a complex graph with multiple inflection points, unexpected events, and dramatic shifts in economic realities. In 2025, entrepreneurs need to prepare for volatile conditions and challenging political dynamics, be agile, and expand into emerging markets for long-term growth.

Regarding the business sector, Vizental suggests that private equity firms in 2025 need to strike a balance between strategic adaptability and disciplined execution, focusing on liquidity, risk management, and digital transformation.

He also emphasizes the significance of Romania's investment climate for the prosperity of the private equity market, stating that the country must align legislation with international standards and encourage local institutional investor participation to attract international private equity interest.