Exceptional Dividend Yield and 13% Annual Return from an Unique ETF

Go for Stable Gains with this Dividend ETF!

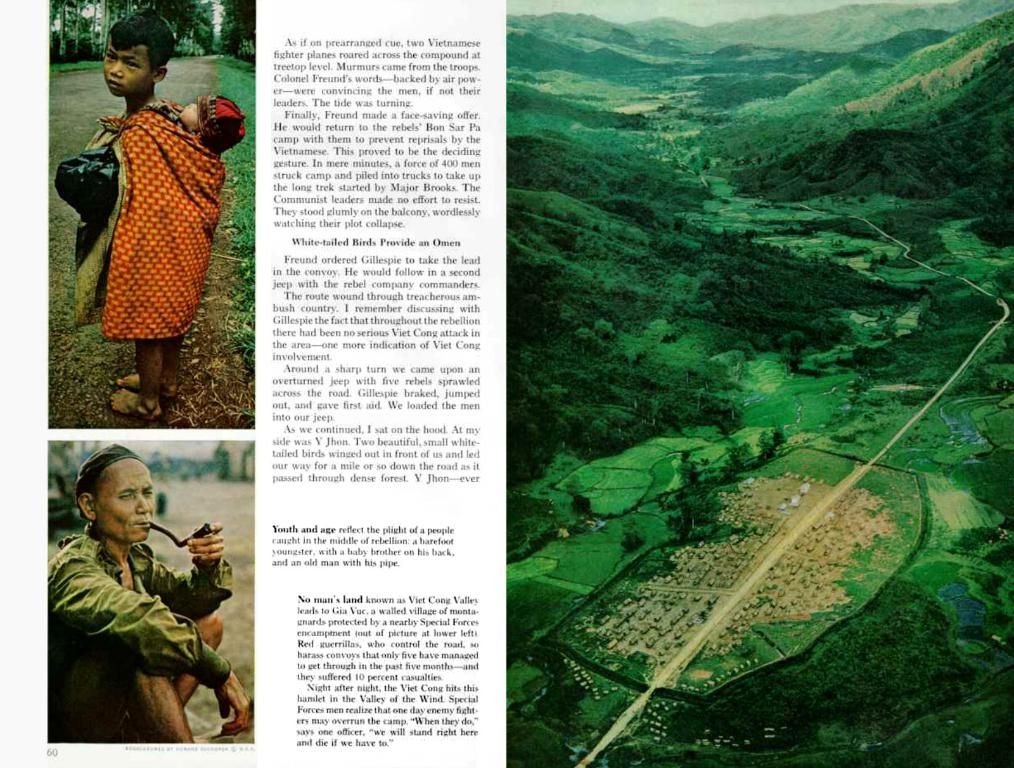

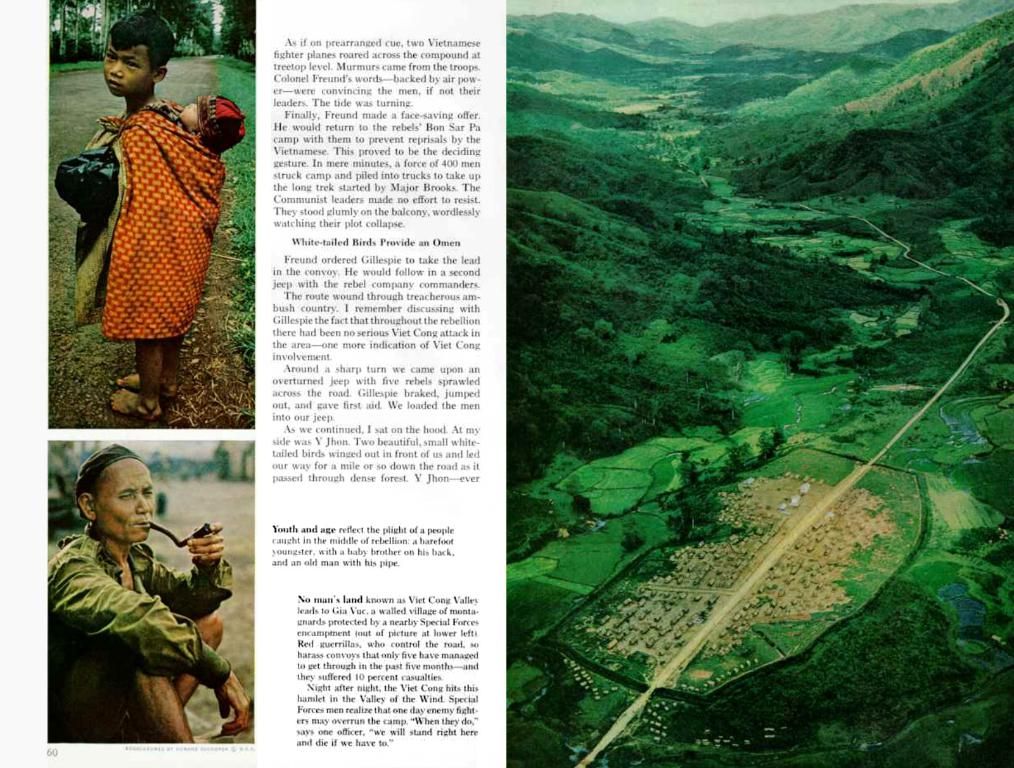

If you're tired of chasing tech stocks or cryptocurrencies for returns, then check out the VanEck Morningstar Developed Markets Dividend Leaders ETF (WKN: A2JAHJ). This badass ETF has managed to bring in a whopping 13% annual return, along with substantial dividends over the years!

Amazingly, this ETF didn't rely on the wild swings of tech stocks or the volatility of crypto. It focused on quality dividend stocks from developed markets, following specific criteria for the companies' financial health. Here's what makes this ETF a powerhouse:

Quality Picks for Long-Term Winnings

The selection process ensures selected companies pass the test of substance and sustainability in their numbers, balance sheets, and debt situations. This approach helps select top-performing stocks over time—a win-win for investors.

Curious about the top 10 holdings? Here they are:

- Chevron Corporation

- Pfizer Inc.

- Verizon Communications

- HSBC Holdings Plc

- Roche Holding AG

- TotalEnergies SE

- BHP Billiton

- Bristol-Myers Squibb

- Sanofi

- Allianz

Hunt for More Dividend Stocks

If you're looking for more dividend-generating gems, check out the BÖRSE ONLINE Global Dividend Stars Index.

Outperformance Without Tech and Crypto Baggage

This ETF's performance proves that eye-catching returns aren't exclusive to tech stocks or crypto. Here's a quick tech check on the VanEck Morningstar Developed Markets Dividend Leaders ETF:

- WKN: A2JAHJ

- Fund volume: 1.24 billion euros

- TER: 0.38%

- Positions: 101

- Yield: 4.0%

- Payout policy: Quarterly

What's Next on the Horizon?

Wondering if Bitcoin will explode soon or if a popular stock will crash? Check out these articles!

Bitcoin and Ethereum: Legal Tender in the Making?

Caution Ahead: This Popular Stock Might Crash Soon—Sell Now?

Note: Boersenmedien AG has a cooperation agreement with the issuer of the displayed securities, granting the issuer a license to use the index. In this context, Boersenmedien AG receives remuneration from the issuer.

If you're interested in personal-finance strategies beyond tech stocks and cryptocurrencies, consider investing in the BÖRSE ONLINE Global Dividend Stars Index. Meanwhile, the VanEck Morningstar Developed Markets Dividend Leaders ETF, with its focus on dividend stocks from developed markets, has demonstrated stable gains without relying on tech or crypto volatility.