During the course of the conflict, Rheinmetall's stock price has seen a substantial increase of tenfold. - During the conflict's duration, the cost of Rhine metal has surged by a factor of ten.

Defense companies used to carry a negative image, but times have changed. Many people now view weapons as essential for defense, and defense companies are highly sought after on the stock market. One such company is Germany's largest defense conglomerate, Rheinmetall. Since the start of the Ukraine war, Rheinmetall's stock price has skyrocketed tenfold, with a share worth 96.8 euros at the beginning of the conflict, and 968 euros in the Xetra market recently.

Rheinmetall manufactures various defense goods, such as tanks, military trucks, artillery, anti-aircraft guns, and ammunition. The demand for these products has increased significantly due to the Ukraine war and heightened security concerns among NATO countries. Rheinmetall even supplies weapons to Ukraine, the country under attack by Russia, and benefits from increased demand from threatened NATO countries.

The company's success can be attributed to its order books, which were 24.5 billion euros at the end of 2021. By autumn 2024, the backlog had almost doubled, reaching almost 52 billion euros. This growth is set to continue when Rheinmetall presents its 2024 annual figures in mid-March. Other defense companies, like Hensoldt and Renk, are also performing well on the stock market.

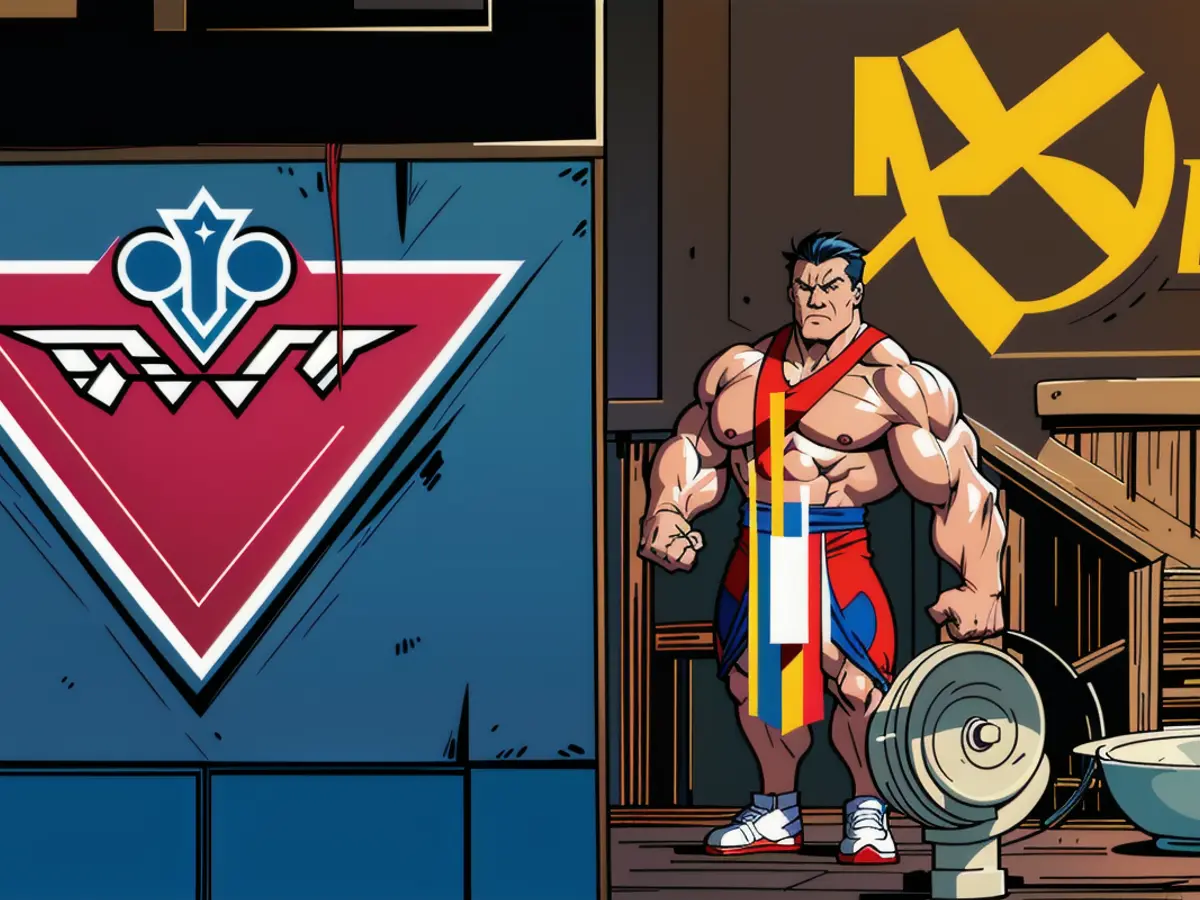

The current demand for defense companies is influenced by geopolitical tensions and shifts in global defense spending. The ongoing conflicts between major powers, like the U.S., Russia, and China, create a "new red Cold War" environment where defense spending is prioritized. The conflict in Ukraine has also led to increased spending across Europe. Technological advancements, such as the integration of artificial intelligence (AI) in defense systems, are also driving demand for new military technologies. Companies that adapt to these technological shifts will thrive in the rapidly evolving defense landscape.

Rheinmetall's success is also due to recent contracts, like supplying C-390 flight simulators to the Royal Netherlands Air Force. The company's ability to diversify its product offerings and invest in innovative technologies, such as cybersecurity, helps it stay competitive. The integration of AI in defense systems is also a priority for Rheinmetall, which is investing in research and development to leverage this technology.

Defense stocks, including those of companies like Rheinmetall, have seen increased investor interest due to their perceived stability and growth potential amid geopolitical uncertainties. This interest is reflected in rising stock prices and increased trading volumes. The ongoing tensions between major powers, coupled with technological advancements, make defense companies a lucrative investment option.

In conclusion, the combination of geopolitical tensions, technological advancements, and strategic contracts is driving the demand and stock market performance of defense companies like Rheinmetall. Despite the negative connotations associated with the arms industry in the past, companies like Rheinmetall are now seen as essential providers of defense products in a rapidly evolving global security landscape.

- The European Union has expressed interest in strengthening its defense capabilities, which could potentially benefit companies like Rheinmetall, given their expertise in the field.

- Amidst the rising demand for defense goods, Rheinmetall's partnership with Ukrainian forces, providing them with essential weapons, has further boosted the company's production and revenue.

- The increased focus on cybersecurity in defense systems has offered Rheinmetall a new avenue for growth, as they invest in research and development to integrate AI and cybersecurity technologies into their defense framework.