Boosting Business Expansion: How Acquiring Business Equipment through Loans Can Spur Development

Equipment financing is a strategic tool that empowers businesses to access necessary machinery and tools without large upfront cash payments. This approach not only preserves working capital and improves cash flow but also helps maintain margins, build sales, and increase market share.

Conserving Capital and Managing Cash Flow

By opting for equipment financing, businesses can retain their cash and existing credit lines for other essentials such as payroll, rent, or emergencies. This conservation of capital supports smoother growth, making it easier to manage cash flow without sacrificing operational capacity.

Affordable Monthly Payments and 100% Financing

Financing spreads the cost over time, making it easier to manage cash flow with affordable monthly payments. Moreover, financing can cover not only the equipment price but also delivery, installation, taxes, and training fees, providing 100% financing.

Obsolescence Protection and Flexibility for Startups

Some lease options allow businesses to upgrade, return, or continue with equipment on flexible terms, reducing the risk of owning outdated machinery. Equipment loans are often quickly approved, sometimes within days, and many lenders accommodate new businesses or those with limited credit histories, especially when equipment has good resale value.

How Equipment Financing Works

To acquire needed equipment, a business applies for a loan or lease. Upon approval, the business immediately uses the equipment while repaying affordable monthly installments over an agreed term, typically a few years. The equipment itself serves as collateral, and if payments stop, the lender may repossess the equipment. At the end of the term, depending on the arrangement, the business may own the equipment outright, return it, or trade it in for newer models.

Future-Proofing Businesses without Compromising Financial Stability

Equipment financing allows businesses to grow operations or upgrade technology while managing expenses, reducing budget constraints, and avoiding large cash outflows at once. This approach can help future-proof a business without compromising financial stability.

In today's competitive market, the right equipment can transform operations, but action is required to explore equipment financing. The steps to obtain equipment financing include identifying the equipment needed, calculating the investment return, choosing a loan option, preparing documentation, and awaiting approval.

Lenders review a business's credit score and financial history when considering equipment financing applications. Overborrowing should be avoided, as should ignoring the total loan cost, not comparing options, and forgetting about maintenance costs. Lenders assess the cost, lifespan, and resale value of the equipment being financed.

A loan for business equipment can unlock potential for expansion, reaching more customers, and operating more effectively. Outdated or malfunctioning equipment can lead to downtime, missed deadlines, unhappy clients, and a stressed-out workforce. Newer equipment typically offers improved performance, faster production times, lower maintenance costs, and increased energy efficiency.

Budget constraints should not restrict a business from applying for equipment financing to upgrade operations and set the business on a path to thrive. Equipment financing is specifically tailored for business-related purchases, and once the loan is paid off, the asset is fully yours, adding long-term value to your business.

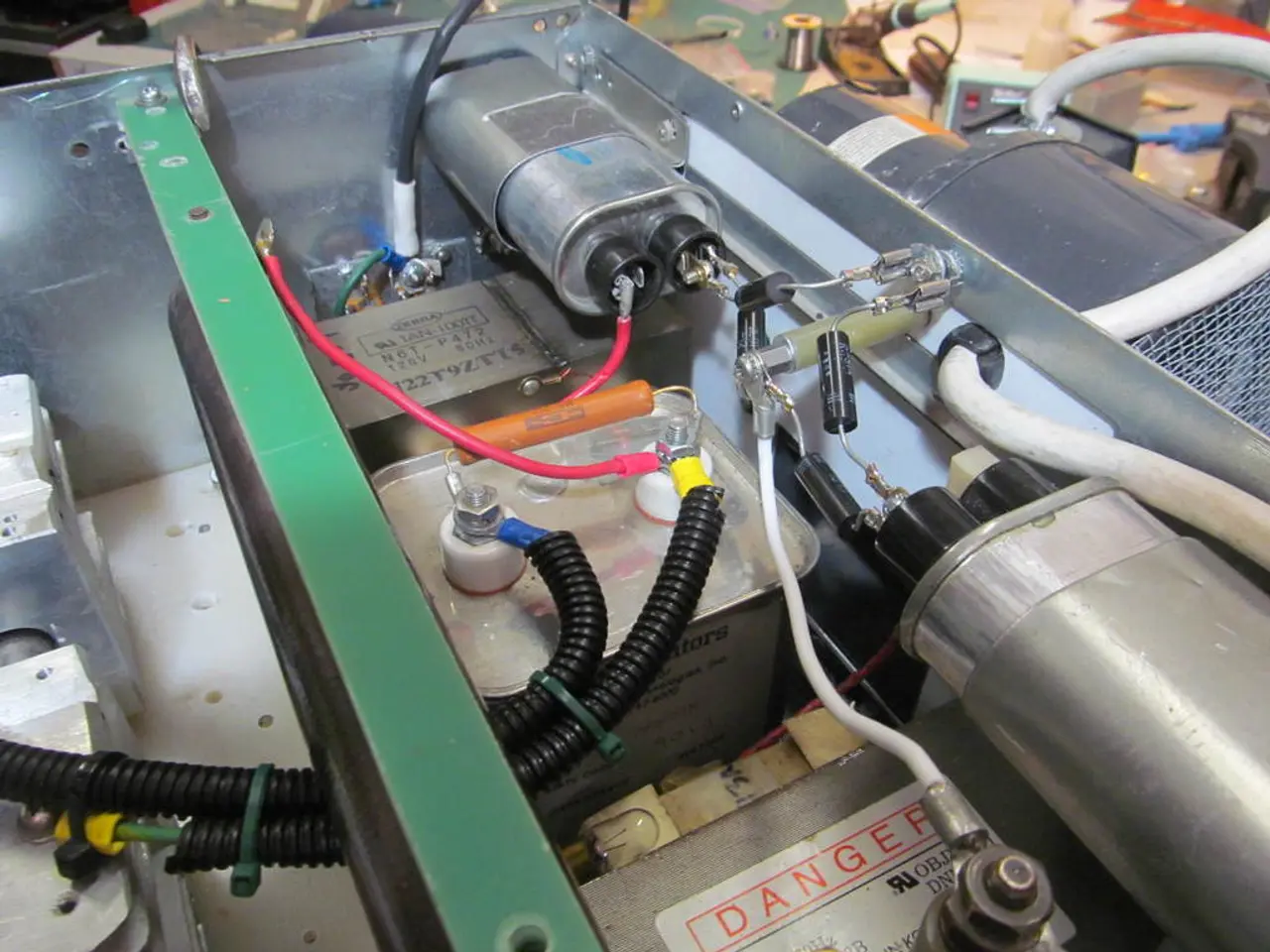

From manufacturing machinery to delivery vans, commercial kitchen appliances, office furniture and technology, medical devices and diagnostic tools, construction and excavation equipment, POS systems and payment terminals, and cleaning or sanitization tools, equipment financing can cover a wide range of items. In today's world, every business relies on equipment for productivity.

Depending on your region and tax laws, you can deduct loan interest or claim depreciation on the equipment you purchase. Equipment financing can help businesses stay ahead or even lead the way in innovation. A clear explanation of the equipment's purpose, benefits to operations, and revenue growth support is necessary for lenders.

In conclusion, equipment financing is a valuable resource for businesses seeking to grow and modernise their operations without compromising financial stability. By understanding how equipment financing works, businesses can make informed decisions and take advantage of this strategic tool to fuel their expansion with manageable financial risk.

- By taking advantage of equipment financing, businesses can buy necessary machinery and tools with manageable monthly payments, improving their cash flow and allowing them to retain working capital for other business expenses, such as payroll or emergencies.

- Finance options can offer up to 100% financing, covering not only the equipment price but also its delivery, installation, taxes, and training fees, making it easier for businesses to invest in the right tools for growth and technological advancement.