Banks on main streets aim to increase mortgage loans by £35,000 for borrowers: Insights provided.

🚀 Banks Loosen the Purse Strings for Homebuyers:

In recent months, several prominent high street banks have eased their mortgage lending rules, enabling more Brits to snag a mortgage for house purchases. It's like they've tossed the thrifty lending playbook out the window! 📖

🗓️ It all started with Santander taking a more lenient approach in their 'stress test,' which is the bit where lenders ensure that borrowers can still afford their monthly payments if interest rates soar. This adjustment could mean an average homebuyer scoring an extra £35k to use towards their dream home! 🏡

🏦 Soon enough, Lloyds Banking Group and HSBC followed suit, bumping mortgage borrowing by a whopping £38k on average. First Direct and Barclays also jumped on board, inching up their loan sizes. 💸

Those first-time buyers, longing for their own piece of the pie, should be particularly overjoyed at this news! 🥧

But Why the Sudden Change?

While it might seem like banks have lost their minds, there's actually a method to their madness. It all boils down to a shift in the lenders' regulatory environment. 💼

📈 The Financial Conduct Authority (FCA) has been nudging lenders to steer clear of unduly restricting mortgage availability that's deemed as affordable, especially as interest rates start to level out. 📉

🗓️ In March, Lloyds, which encompasses Halifax, Bank of Scotland, BM Solutions, and Lloyds Bank, received the green light to loosen their purse strings, allowing the typical household to secure an extra £38k. 🤑

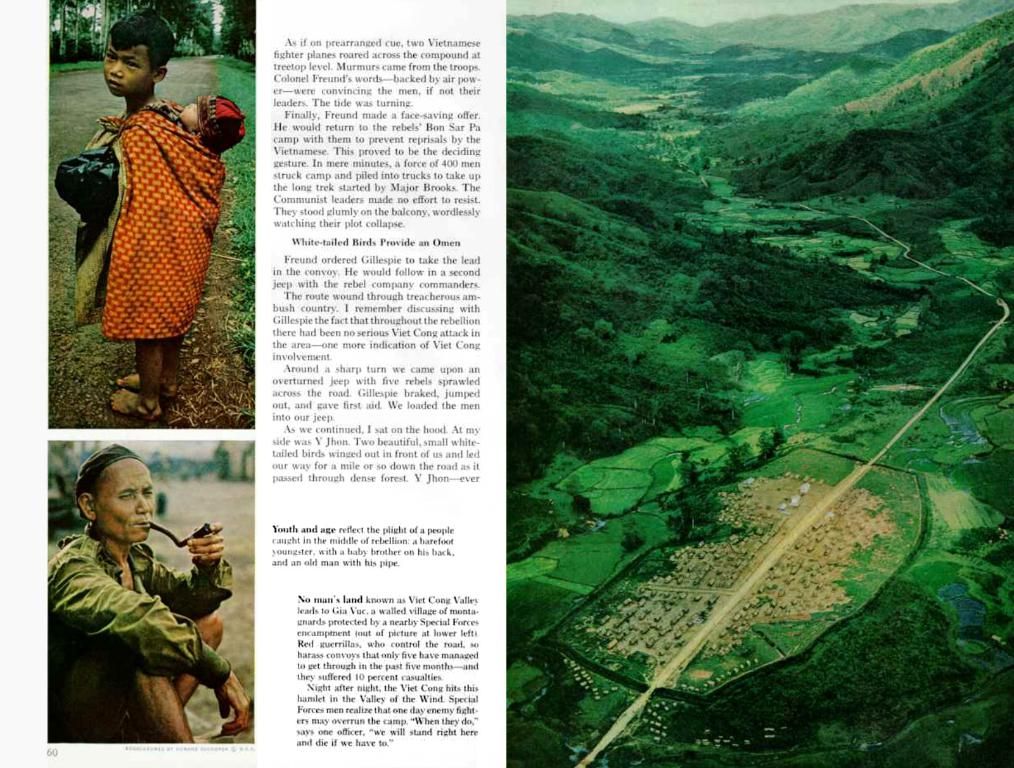

📝 David Hollingworth, associate director at L&C Mortgages, explains: "Stress rates aren't usually published, but have traditionally been a margin above the reversionary rate, often the SVR. As rates have risen, affordability has often become tougher, as stress rates have followed suit. The regulator recently issued a reminder to lenders that they can exercise some flexibility in how they implement stress rates, and lenders have certainly taken advantage of that." 📉

📊 Yesterday, Savills reported that this relaxation of mortgage stress tests could cause the number of first-time buyers to surge by up to 24% over the next five years. That means over 80,000 additional people joining the housing market! 🎉

📈 On the other hand, there's the looming concern that looser mortgage lending rules could cause property prices to soar. If we up the borrowing without building new homes, we risk fueling rising house prices. 🏡

📝 If you're a would-be buyer, you might be thinking: "At last! I can finally score a mortgage without breaking the bank." That's all well and good, but don't forget the underlying problems that remain: high house prices and a chronic lack of supply. 🏗️

👉 Even though banks are lightening up on their mortgage stress test rules, the loan-to-income-ratio remains a key concern. This limit is a cap on the amount banks can lend based on someone's annual income. Most borrowers will only qualify for a mortgage of up to 4.5 times their annual household income. 💰

📝 While lenders can now offer larger loans to more people, they are still constrained by the Bank of England's rule that only 15% of their mortgage book can be made up of loans above the 4.5 times multiple. This archaic rule is causing headaches for borrowers. 🤔

- With banks easing mortgage lending rules, more Brits can now secure larger mortgages for property purchases, a shift that began with Santander's lenient stress test.

- On average, Lloyds Banking Group, HSBC, First Direct, and Barclays have increased mortgage borrowing by approximately £38k each, making it easier for house buyers to afford their dream homes.

- The Financial Conduct Authority (FCA) has been encouraging lenders to ensure mortgage availability remains affordable, particularly as interest rates level out, leading banks to adjust their mortgage stress test rules.

- Savills predicts that the relaxation of mortgage stress tests could lead to a 24% increase in first-time buyers over the next five years, equivalent to over 80,000 more people entering the housing market.

- While larger mortgages may fuel the housing market, concerns remain about the potential for property prices to rise if new homes are not built commensurately, leading to an affordable housing shortage.