Assessing British American Tobacco: Could This High-Dividend-Yield Stock Be a Wise Investment in 2025?

High-yield dividend stocks like British American Tobacco (BAT), with an eye-catching 8.2% yield, can be a conundrum for investors. On the one hand, historical data shows they can outperform the S&P 500 over long periods when dividends are reinvested. However, high yields often serve as a caution sign, suggestive of a company's best days potentially being in the past.

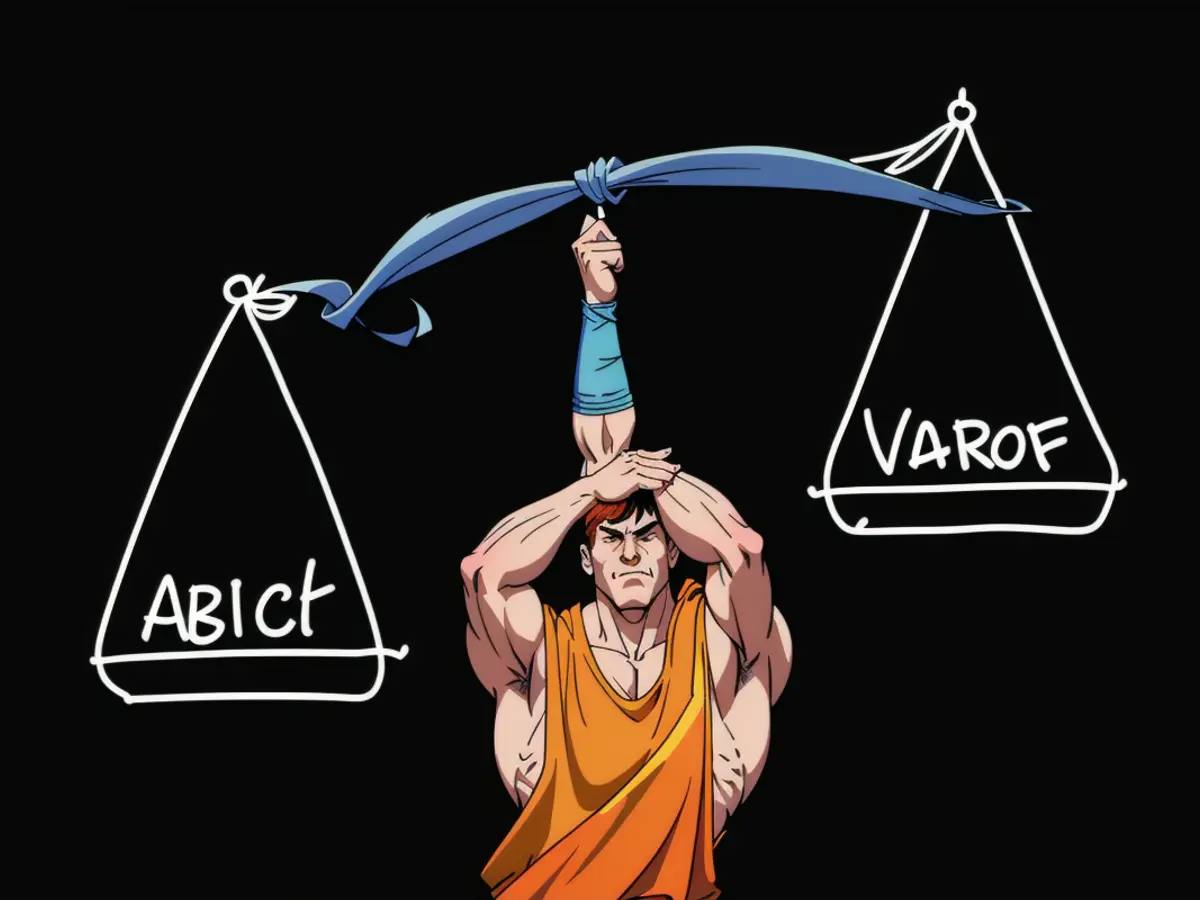

BAT, known as BTI, is a prime example of this dynamic. Despite its impressive dividend yield, its shares have underperformed both the wider market and many tobacco industry peers over the last decade. So, is BAT an undervalued opportunity for contrarian investors, or is the high yield masking underlying problems?

The Business Case

BAT is the world's second-largest tobacco company by volume, although global cigarette consumption decreases approximately 5% annually. To counter these declines, BAT has invested heavily in next-generation nicotine products. In the U.S., BAT holds a strong market position, owning several leading tobacco brands and maintaining about a third share of the market.

Transitioning to Next-Generation Products

BAT's foray into alternative nicotine products has yielded mixed results. Glo, the heated tobacco product, has recorded modest success, but it trails Philip Morris International's dominant iQOS platform. BAT's Velo in the modern oral category has faltered, losing market share despite the segment's robust growth. The only notable success has been the global vaping market with the Vuse brand.

Financial Health and Outlook

BAT's substantial dividend payout of around 60% appears sustainable. A payout ratio above 75% generally raises red flags, which hasn't been the case with BAT.

Valuation-wise, the stock trades at a significant discount to the S&P 500's multiple due to the challenges faced by the combustible tobacco market. Wall Street anticipates low-single-digit organic revenue growth for BAT this year, driven by pricing power in traditional tobacco and gradual gains in next-generation products.

Investment Merits and Risks

BAT's strengths lie in its strong U.S. market position and pricing power in traditional tobacco. Its global expansion and geographic diversity create natural protection against country-specific regulations and consumer preferences' changes.

However, challenges such as BAT's weak position in heated tobacco products, compared to Philip Morris International, and a stagnant global vaping market pose substantial hurdles. Currency exposure is also a noteworthy risk given BAT's substantial dollar-denominated debt.

Verdict

BAT represents a classic value-trap dilemma. Its eye-catching dividend yield, and low valuation might attract income investors, but the company's struggles in next-generation products and declining core business might justify the market's pessimism. The investment case relies on whether BAT can harness its strong U.S. market position and pricing power to successfully transition to alternative products. Due to mixed results in other categories and significant currency risks, more enticing opportunities exist for income-focused investors.

In light of the text, here are two sentences that contain the words 'investing', 'money', and 'finance':

Investors may be attracted to the high yield of BAT's dividends, suggesting an opportunity for income-focused investing with their money. However, assessing the overall financial health of the company and its ability to transition to next-generation products is crucial when considering potential investments in BAT's stock.