Let's Chat: The Debate Over Including Civil Servants in the Statutory Pension System

- Penned by Nadine Oberhuber

- Approx Read Time: 4 minutes

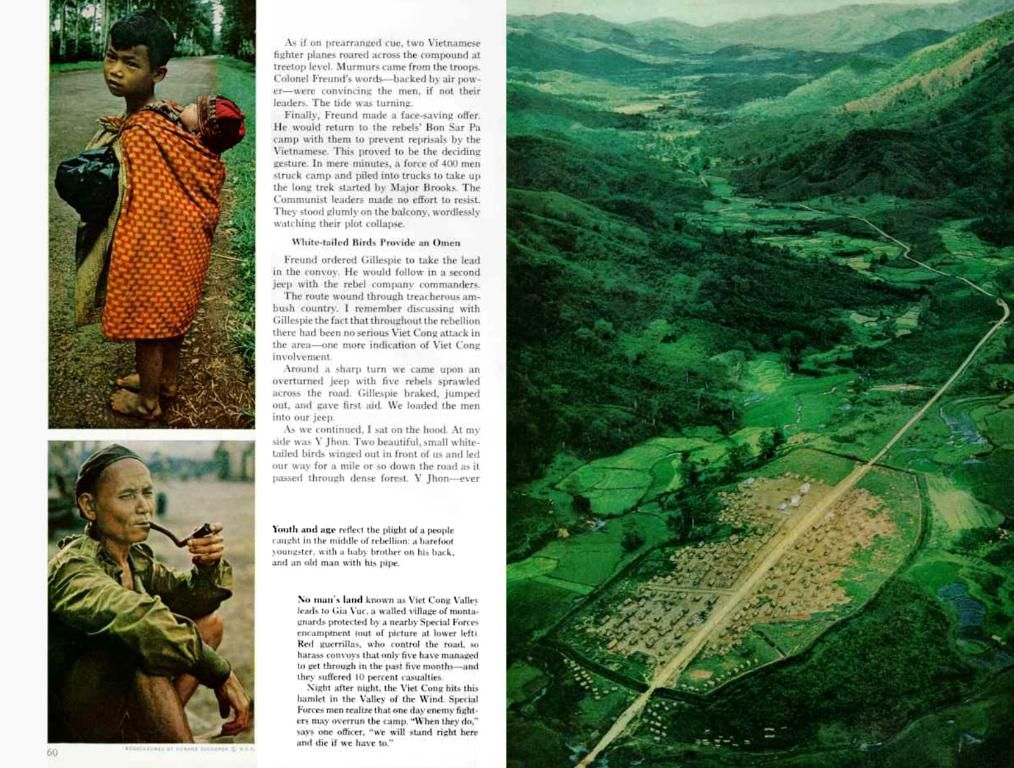

Civil servants should make contributions towards their retirement fund for financial security. - Allowing Public Servants to Contribute to Their Retirement Savings Fund

In the realm of pension discussions, a contentious issue stealing the limelight is the proposal made by Labor and Social Affairs Minister Barbara Steffens (SPD) to incorporate civil servants, members of the German Bundestag, and self-employed individuals into the statutory pension system as regular contributors. While the CDU contradicts this proposition, stating that it fails to address the pension fund's financial struggles and isn’t a coalition agreement topic, the idea still garners support. Let's dive into the pro's and con's of this proposal.

The Rationale: Why Should Civil Servants Contribute to the Pension Fund?

The Case for Integration

- Transparency and Fairness: Intertwining civil servants with the statutory system would make the entire German pension scheme more transparent, thereby fostering perceptions of fairness. By addressing civil servants' basic old-age security through the statutory fund, their generous occupational supplementary pension would be separately fundable through extra contributions from the federal, state, and local governments-a move that aids regular pensioners in avoiding feelings of injustice towards civil servants.

- Political Harmony: Such a change could boost the political manageability of the pension system, as it would accelerate the implementation of uniform changes across employee groups, much like what experts have been advocating for since 1989[3].

The Critics: A Few Reasons Against Integration

The Argument Against Inclusion

- Complexity and Resistance: The integration process would cause intricate, prolonged alterations, resented by civil service unions. Disruptions to existing pension benefits are a potential negative consequence.

- Resource Strain: Introducing civil servants into the statutory system might overburden the pension fund financially, given the need to accommodate additional beneficiaries.

- Lost Privileges: Civil servants often benefit from unique advantages, which might be at risk as a result of integration. This may generate opposition from civil service organizations.

The Effect on Transparency and Financial Sustainability

Transparency Advantages

- Streamlined Perception: Integration would simplify the pension scheme, offering a more uniform structure that is easier for the public to comprehend.

- Unified Regulations: Beneficiaries from all employment categories would be subject to the same reporting and disclosure requirements, eliminating confusion and enhancing comprehension.

Financial Sustainability Challenges

- Monetary Burden: Integrating civil servants may heighten the financial strain on the statutory pension system, potentially putting its long-term sustainability at risk.

- Reform Necessity: The integration process could push for broader reforms to ensure the system's financial stability, such as increasing contributions, adjusting benefit formulas, or incorporating more private pension elements[4].

- Data-Driven Decision Making: Making the integration process informed and effective necessitates data-driven decision-making, employing predictive models to evaluate the pension fund's financial outlook and make data-driven policy decisions.

Ultimately, integrating civil servants into the statutory pension system requires a fair, calculated examination of the potential benefits and risks to maintain transparency and safeguard the integrity of the system. Let's remind ourselves that the aim is to create a fairer, more sustainable pension system for all Germans.

- Pension

- Civil Service

- Retirement

- Pension Reform

- The proposed incorporation of civil servants into the statutory pension system aims to increase transparency and fairness, as it would make the entire pension scheme more understandable and create a uniform structure that benefits regular pensioners.

- The financial sustainability of the pension system could be affected if civil servants are integrated, as there may be a monetary burden that could potentially risk the system's long-term sustainability and necessitate broader reforms such as increasing contributions or adjusting benefit formulas.